Arm deals blow to UK tech industry by rejecting London listing for a NASDAQ flotation

Cambridge-based technology firm Arm said it will pursue a US-only stock market listing this year, dealing a blow to the UK markets.

The plans from the company, owned by Japanese investment giant SoftBank, come despite heavy lobbying by successive prime ministers and cabinet members.

In January, Rishi Sunak reportedly restarted talks with SoftBank to persuade it to list the computer chip maker in London.

Arm indicated it could still look at an additional UK listing in the future but provided no further details.

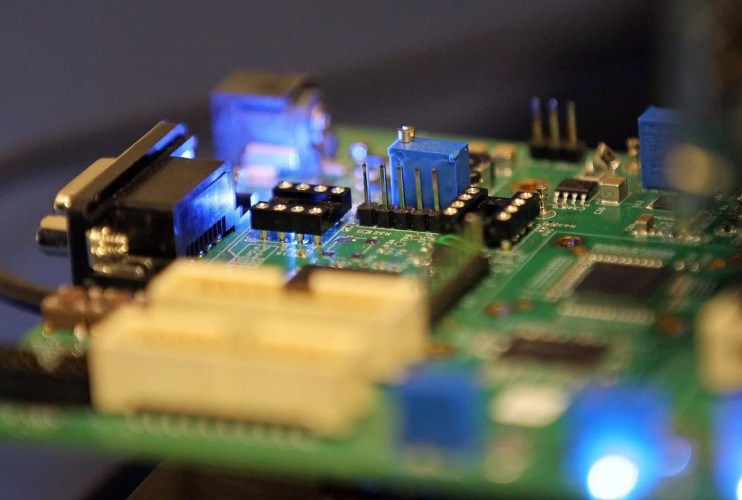

On Friday, bosses at Arm, which designs chips used in almost every smartphone, stressed that it will continue to expand and invest in the UK.

Chief executive Rene Haas said: “After engagement with the British government and the Financial Conduct Authority over several months, SoftBank and Arm have determined that pursuing a US-only listing of Arm in 2023 is the best path forward for the company and its stakeholders.”

The move is the latest blow to London, where Arm was listed until it was snapped up by SoftBank for £24.6 billion in 2016.

SoftBank last year decided it would seek to float the business back on the stock market after a $40bn (£33.4bn) takeover by US firm Nvidia was blocked over competition concerns.

The listing plans come a day after building materials giant CRH revealed it is planning to shift its main stock market listing from London to New York.

CRH, which is headquartered in Dublin and valued at more than £30 billion, said: “We have now come to the conclusion that a US primary listing would bring increased commercial, operational and acquisition opportunities for CRH.”

Russ Shaw CBE, founder of Tech London Advocates and Global Tech Advocates said Arm’s intention to list on the NASDAQ was a significant blow to the UK tech sector.

“It’s disappointing news for the London Stock Exchange and the heritage and future of the UK semiconductor industry. Arm has been an important global leader in the semiconductor space and an exemplar British technology and chip design company. “

Shaw said there were glimpses of hope from Arm that it still recognised a commercial value in keeping roots in the UK.

“For example, they are keeping their HQ and material IP in Cambridge and that they plan to open a site in Bristol – but it’s a far cry from an LSE listing and demonstrates a lack of faith in the UK. The decision adds urgency to the need for the UK government to publish its long-awaited semiconductor strategy, which we called on government to publish in January in an open letter to the Prime Minister.”

“Ultimately, this will reinforce valuable lessons. Arm’s decision must be upheld as a case study for the UK Government of how ‘not to do it’. Arm’s journey to the NASDAQ was somewhat sealed when it was allowed to be sold to an overseas acquirer back in 2016. Nations like the US and China that recognise the strategic value of chip companies would not have allowed such decisions to be made – then or now – and the UK must now endeavour to proactively protect its semiconductor industry.”

Press Association