Are you motivated by morals or money?

Investing is a personal choice and a number of influences will hold sway over where you put your money. Your personal value system is one such influence and, for most people, this appears to be non-negotiable.

More than three-quarters (77 per cent) of investors refuse to compromise on their personal beliefs when investing, even if higher returns were on offer, new research suggests.

These findings are part of the Schroders Global Investor Study 2020, which canvassed the views of more than 23,000 investors from 32 locations around the world between 30 April and 15 June.

What would it take for you to compromise your beliefs?

For the 23 per cent of investors that would be willing to compromise, the returns would have to be significant – at least 21 per cent – to convince them to do so.

This is almost double the average annual return that investors expect over the next five years.

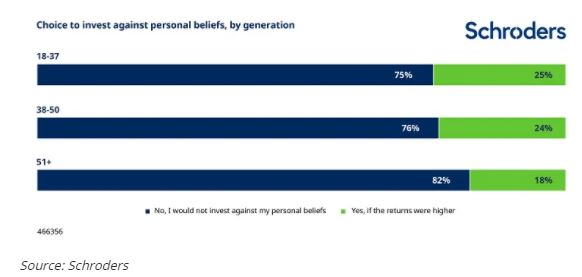

How age influences your actions

It also seems that the older the investor, the less likely they are to be willing to forgo their personal values.

While 75 per cent and 76 per cent respectively of 18 – 37 year olds and generation Xers (38 – 50 year olds) would not invest against their personal beliefs, 82 per cent of those over 51 years old wouldn’t pick higher returns if these came at the expense of their personal beliefs.

Beliefs vs returns by geography

The results also vary significantly by country.

The data suggest the Chinese are the most committed to investing in line with their personal beliefs, with 90 per cent of respondents reporting they’d not sacrifice their values when investing.

At the other end of the spectrum are investors in the US and Singapore, a full third of which would invest against their beliefs if it meant higher returns.

Investing with morals doesn’t have to impact returns

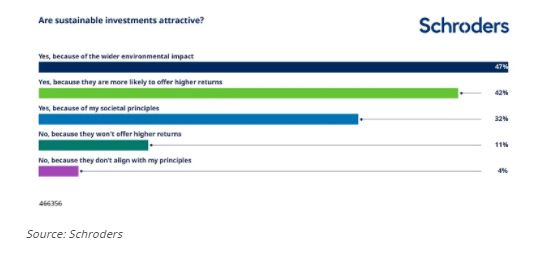

Previous studies have revealed that investors are still concerned that they have to sacrifice returns for sustainability.

It’s encouraging to note that this year’s study shows that 42 per cent of investors are attracted to sustainable investments because they believe they’re more likely to offer higher returns.

Hannah Simons, Head of Sustainability Strategy, is encouraged by the results overall. She says: “The results of this year’s survey are clear – returns are not the only influence of investment decisions. People want their values reflected in the way they invest. People are increasingly looking to contribute to a more sustainable society through their investments.

“Sustainability does not have to come at the expense of performance and it is promising to see this manifesting more strongly each year in the data.

“Communication is key if investors are to understand what sustainable investing really means and what this looks like in their portfolios, and this is a core focus for us.”

To learn more visit Schroders Global Investor Study hub or Schroders Sustainable Investment home page

Schroders commissioned Raconteur to conduct an independent online study of 23,450 people in 32 locations around the world between 30 April and 15 June 2020. This research defines “people” as those who will be investing at least €10,000 (or the equivalent) in the next 12 months and who have made changes to their investments within the last 10 years.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.