Are the days of the US dollar as world’s reserve currency numbered?

The US dollar has been the world’s reserve currency for more than 100 years, but how long will it be before we seen a new unit of exchange replacing it? Arguably, payment platforms have upgraded their infrastructure so they are able to process transactions using digital currencies – so will the USD be replaced by some form of digital currency backed by China or a basket of global assets?

“Every dog has its day” is an expression believed to have come from around 405 BC when a Greek playwright, Euripides, was mauled and killed by a pack of dogs. An analogy to this tale could be the US dollar. So, is the end nigh? That is, has the mighty greenback ‘had its day?’

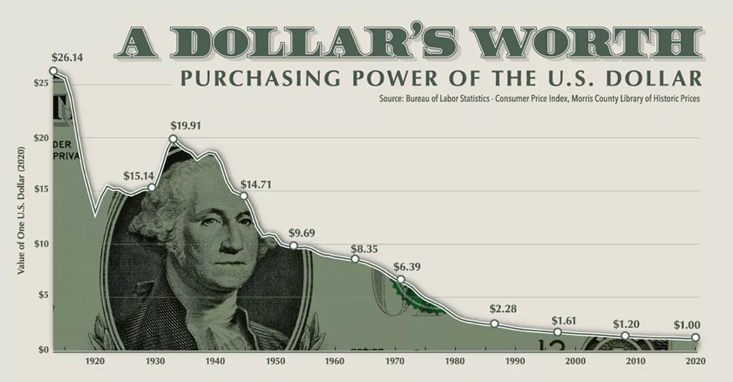

Historically, world reserve currencies have been typically superseded and replaced as the result of military conflicts but will the US$ be replaced, not by war but a result of economics? Whilst the US economy is still the largest in the world its economic dominance has declined, and continues to, as a percentage of global GDP. As the newspaper, the Independent, has reported, even in the field of renewable energy: “America is losing its superpower status to China… Between 2010 and 2020, China outspent the US by nearly 2-to-1 on energy transition-related investments and leads in renewable energy employment”. Meanwhile, the key attributes a world reserve currency needs are confidence and trust for companies and countries to use it, both as a medium of exchange and a store of value. However, it would seem that as a store of value the US$ does not have a great track record.

Decline in the value of the US$

Source: Libertas Wealth

As we increasingly see our lives becoming more digitised, national geographic boundaries seem to matter less. So, will a digital currency replace the US$? One of the recurring reasons that organisations cite for using blockchain technology is the transparency that it offers and transparency helps to build trust and any new currency will need to be trusted. The global economy has been faltering along under a mountain of debt and the levels of global debt have reached, what some believe to be, unsustainable levels.

Global debt issued by governments is now more than $71trillion – this ‘binge’ on borrowings having been fuelled by weak economic growth as a result of the COVID-19 pandemic. Governments have forced interest rates down, potentially breaking their own laws by engaging in ‘monetary financing’. In fact, this practice is illegal in many countries such as Japan and Europe and occurs when a central bank creates money to buy government bonds, in effect, enabling those governments to spend without limits.

Back in 2014, it was prohibited for the European Central Bank (ECB) to do this. Indeed, its quantitative easing programme is already in question by the German Constitutional Court, which has threatened to no longer provide the ECB with further financial support. Germany’s Constitutional Court reached a verdict in May 2020, determining that the ECB had potentially acted illegally in buying €2trillion of government bonds. Moreover, Germany is owed over $2trillion and the recent Russian-Ukraine conflict will only escalate inflation rates globally, whereby further intensifying pressure for interest rates to be increased.

Given France, Germany and Italy are Europe’s biggest buyers of Russian gas but finding alternative energy suppliers will certainly not be possible – quickly or cheaply – this will undoubtedly put add further inflationary pressures across the EU. Could this subsequently mean the beginning of the end for the euro?

Meanwhile, the US government debt has increased to 98% GDP (at $30+ trillion) as of April 2022, and the Chinese have over $10.5trillion of government debt equating to 60% of GDP. In the US, corporate share buybacks continue which has resulted in only three companies in the S&P 500 having no debt – these being Abiomed, Intuitive Surgical and Monster Beverage.

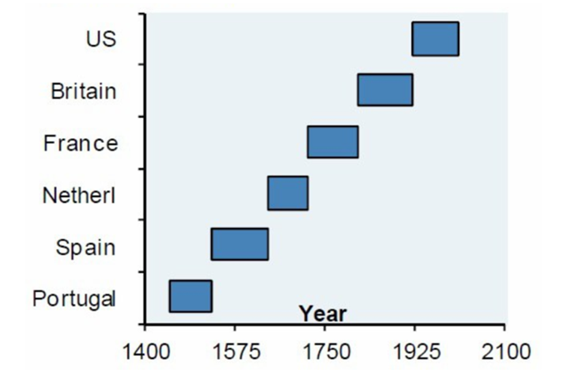

The US$, itself, has been the reserve currency for 99 years, so has the time come for it to be replaced? After all, America’s currency replaced Britain’s, which replaced France’s, which replaced Holland’s, which replaced Spain’s, which had replaced Portugal’s currency back in the 15th century! So over 540 years of history seems to indicate that the average tenure for a world currency is 94 years yet the US$ has already exceeded this.

The world reserve currencies historically

Source: JPM / Hong Kong Monetary Authority, 2011

Unremittingly, there is no doubt that a growing debt burden becomes a big problem for everyone. According to the World Bank, the ‘tipping point’ is reached when a country’s debt-to-GDP ratio approaches/exceeds 77%. Well, the US is well beyond that at 98%! The COVID-19 pandemic certainly exposed the fragility of complex international supply chains and the Russian invasion of Ukraine has highlighted how the world is potentially at the mercy of what may well be unreliable suppliers of commodities, such as petrochemicals and/or grains .

Will this lead to growing nationalisation and an end of the era of hyper-globalisation – being mindful that the US and Australia both remain in a trade war with China? As people focus more on corporations’ Environmental Social corporate Governance (ESG) credentials and a demand for more equality in society, is the US’s ‘free-wheeling capitalist style’ genuinely what the world aspires to, going forward?

So, in view of all this, what could replace the US$ as the world reserve currency? The US will certainly not relish seeing the once mighty greenback (aka US$) displaced, so how long before we see a new currency knock the dollar off its perch? Evidence exists of more and more jurisdictions trading oil, gas and other commodities, as well as settling in other currencies as opposed to the US$.

The Saudis have been rumoured to be willing to accept the Chinese Yuan instead of the US$, meaning could this be a sign of the beginning of the end for the petrodollar and subsequently the end of a US$ world reserve currency? Rather than a national currency replacing the US$, could a digital currency supplant it? A digital currency backed by a real, tangible asset such as a basket of equities, bonds, commodities etc…

The ‘knee-jerk’ answer would probably be a digital currency, one of which has recently been launched by the world’s second biggest economy – China. To gain international usage, will the Chinese insist that its digital currency become the method of payment at the airports, railways, roads, bridges, and harbours that China have paid and constructed as part of China’s Belt and Road initiative (BRI) of which over 146 countries have now joined.

Indeed, both the IMF and Bank of International Settlement have been advocating digital currencies for a while and, notably, there are many nations presently researching digital currencies for their own countries. Alternatively, could we see a new global currency secured against global real estate – an asset class which Savills claims is worth over $326 trillion globally? To put this in perspective, the value of cash circulating around the world – i.e: physical cash (coins, notes) and virtual electronic bank accounts is $40 trillion.

Regardless of this, though, is one of the major challenges digital currencies run on a blockchain-powered platform have had to address is the number of transactions a blockchain can process a second. But, according to Analytics Insight, this issue could now potentially be solved since “TechPay Coin’s Performance proved to be 43,000 times faster than Bitcoin, 20,000 times faster than Ethereum, and even 4.5 times faster than Solana, Making it the quickest infinitely scalable Blockchain to date”.

So, consider just for a moment, when was the last time that you used cash? Indeed, do you even have cash on you or do you rely on debit cards, credit cards or your mobile phone to pay for goods and services? We have seen an explosion in the use of challenger/neo banks and payment platforms, many of whom are now able to accept and process digital currencies. Therefore, arguably, the infrastructure is in place for a digital currency to replace the US$ as the world currency. The question is – are you ready, and how would it impact your business and family finances?