Are investors adjusting to the new normal?

Potential for recovery following Covid-19 and trends which have accelerated as a result of it give many reasons for optimism heading into 2021

The list of reasons for investor uncertainty heading into 2021 remains long.

A global pandemic. Lockdowns. Volatile markets. Political turbulence. Uncertainty over jobs and the economy. Record levels of government borrowing – and questions over how it will be repaid. Lower interest rates – and talk of them turning negative. Working from home.

Given all this, it’s perhaps unsurprising that investors are now reviewing all aspects of their lives, not just their portfolios. For some, the balance has tipped to early retirement.

A significant number of people are actually bringing forward their retirement date as a result of what’s happened this year. One in four respondents to the Schroders 2020 UK Financial Adviser Survey said they have clients who have done this.

If you’re in that group able to bring forward retirement, that’s great. However, for the rest of us yet to draw down a pension there are many positives to focus on as we head into the new year.

Discover more from Schroders:

– Learn: Can asset management’s Covid-19 response help regain public trust?

– Read: Is the vaccine the shot in the arm the market needs?

– Watch: How climate change could affect your investment returns?

Will UK equities recover after Brexit?

The idea of UK equities coming back into fashion has long been discussed. However, with Brexit negotiations reaching their denouement it may be about to happen. Financial advisers could be sensing a reversal of fortunes in the not too distant future.

According to our survey there has been a significant change in the number of advisers looking to allocate to UK equities – while 65% have decreased allocations over the last 12 months, 40% are now looking to increase allocations over the next 12 months.

The survey was conducted just prior to the US presidential election and to the Pfizer/BioNTech, Moderna and University of Oxford/AstraZeneca vaccine news. It showed 45% of advisers consider “Recovery from Covid-19” to be a distinct investable theme. So renewed interest in UK equities is perhaps unsurprising, given the market has been one of the major regional market laggards of 2020.

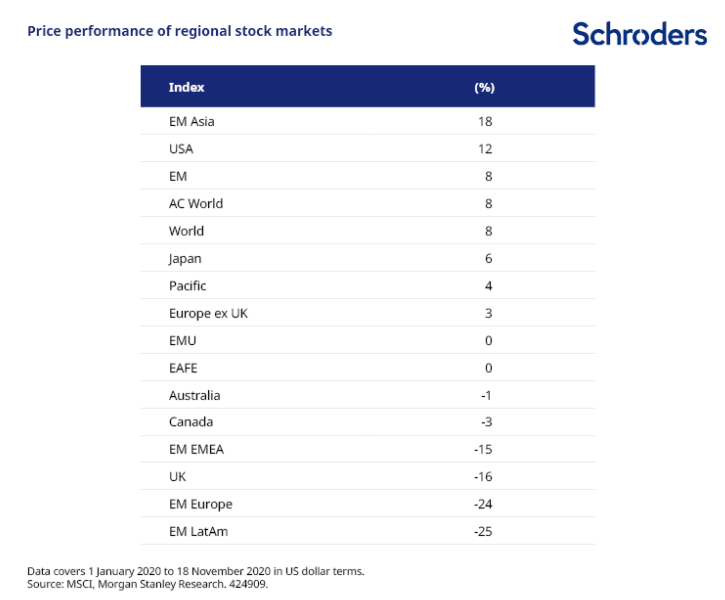

While the response to the recent vaccine breakthrough has helped close this gap, UK equities still remain in negative territory year-to-date, and some way behind other equity markets, as illustrated by the chart below.

Past Performance is not a guide to future performance and may not be repeated.

The investments trend that could dominate the next five years

But investors should not overlook the significance of the many changes which were already under way before the crisis. Many of these trends have accelerated as a result of it .

The majority of advisers have told us disruption will remain a major investment theme over the next five years. This echoes one of our Inescapable Truths; that of technological change. Covid-19 has accelerated this and other important trends (see Covid-19: the inescapable truths faced by investors)

E-commerce trends have raced ahead since the start of 2020, seemingly making years of progress in a matter of months. Consumption trends have changed dramatically, with some changes potentially here to stay.

Meanwhile, many companies have decided that working from home two-to-three days a week will be the new normal once the crisis has passed. Clearly this has accelerated the challenges faced by investors in offices and retail property. However, there have been beneficiaries too.

Two decades ago retail and offices dominated property portfolios. Could data centres and other beneficiaries of the modern economy become mainstream in five years’ time, with retail and offices seen as the alternative property asset to own? It’s an interesting question.

The rising importance of ESG

We can all see in our daily lives the growing importance of environmental, social and governance (ESG) considerations. Unsurprisingly, these considerations are also being reflected in the way custodians of our assets manage them.

Our survey underlined how ESG has become an even more central consideration to advisers and their advisory clients in the past 12 months.

Almost three quarters of advisers reported that they explicitly consider ESG factors when selecting funds for clients, up from less than half in November 2019.

Without doubt, regulatory considerations have been a “push” here, but clients are driving the agenda too. 14% of advisers told us that more than a quarter of their clients explicitly specify that their investments should reflect ESG factors in some way. This has risen from 9% the previous year.

Covid-19 has highlighted for advisory clients why ESG is important and increased awareness.

Not-so-great return expectations

If Covid-19 has changed many things, others have stayed the same, including expectations for low returns. The majority of advisers we asked expect little change in interest rates and lower returns from bonds versus historical averages.

Low interest rates, or negative interest rates is one of the key challenges to consider heading into 2021. A lot of the fixed income sector is not doing the job it used to due to the low yields on offer, but some areas of credit are really interesting. When I study fund flow data I see plenty of demand in this area.

Active investors are finding interesting opportunities for good income today from high quality companies.

It’s been a challenging year for investors and the long-term consequences of the global pandemic are yet to be fully understood. Despite these uncertainties there are many reasons for optimism heading into 2021, both with regards to the potential for recovery following the crisis, and in relation to trends which have accelerated as a result of it.

- For more on what lies ahead for the UK stockmarket, please see our article Outlook 2021: UK Equities.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.