Architects of UK financial rules question direction of Edinburgh reforms

Two leading architects of the UK’s financial regulations today questioned the idea of giving regulators a competitiveness mandate and warned that reforms to Solvency II could expose the financial sector to greater risks.

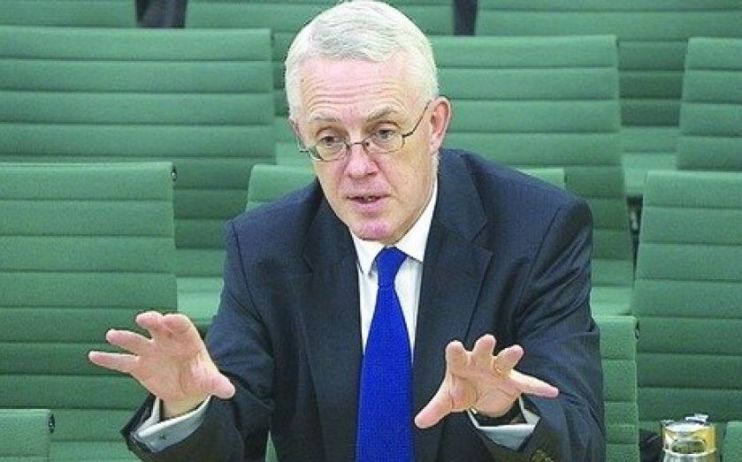

In a Treasury committee hearing today, John Vickers, chair of the independent banking commission, doubted the idea of giving financial regulators a mandate to promote the UK’s competitiveness, laid out as part of the so-called Edinburgh reforms.

He questioned whether it was “a wise path to take”, and stressed it was better to focus on the wider economy rather than give the financial sector “special treatment”.

“The competitiveness, which should matter to us all, is that of the UK economy as a whole, for that objective we need very strong and sound financial institutions… anything that puts the primary objective at risk would be a very unfortunate step to take,” he said.

“It is better to stick to the objectives the regulators already have,” Vickers added.

Keith Skeoch, chair of the independent panel on ring-fencing and proprietary trading, agreed, identifying the speed at which financial innovations are adopted as a key issue regarding competitiveness.

“When you look back, too much was adopted too quickly and lightly regulated which caused the problems of the last 20 to 30 years”, he said.

The pair also agreed that the government’s proposed changes to Solvency II, which would reduce capital buffers on insurance companies, would increase risk in the financial sector.

Vickers said that if risk increases in the insurance sector without a corresponding increase in capital buffers, then one elevates “the risk that those institutions won’t be able to meet their liabilities.”

He said he could not “exclude the possibility” that the repeal of Solvency II could lead to systemic financial instability, although he stressed the possibility was small.

Skeoch said there needed to be “an appropriate and prudential level of capital” to mitigate risks from Solvency II reforms.

On ring-fencing, the separation of retail and investment banking, the pair agreed that the UK’s retail banks were “undoubtedly safer” and also faced lower funding costs thanks to the regulations.

However, Skeoch was more optimistic than Vickers that stronger resolution rules could remove the need for ring-fencing in future.

Resolution rules are designed to ensure the continuation of critical functions across both sides of the ring-fence in a bank.

Vickers said that while resolution regimes might work if one bank collapsed “if the whole fleet went down, I don’t know [if they would work].”

Maintaining ring-fencing rules would not only “assist resolution”, Vickers said, but also provide a “healthier incentive system” to improve culture in banks and “a basis for different capital requirements” to weight risk in different banking divisions.