Aramco ramps up fossil fuel spending as oil and gas firms ease off green agenda

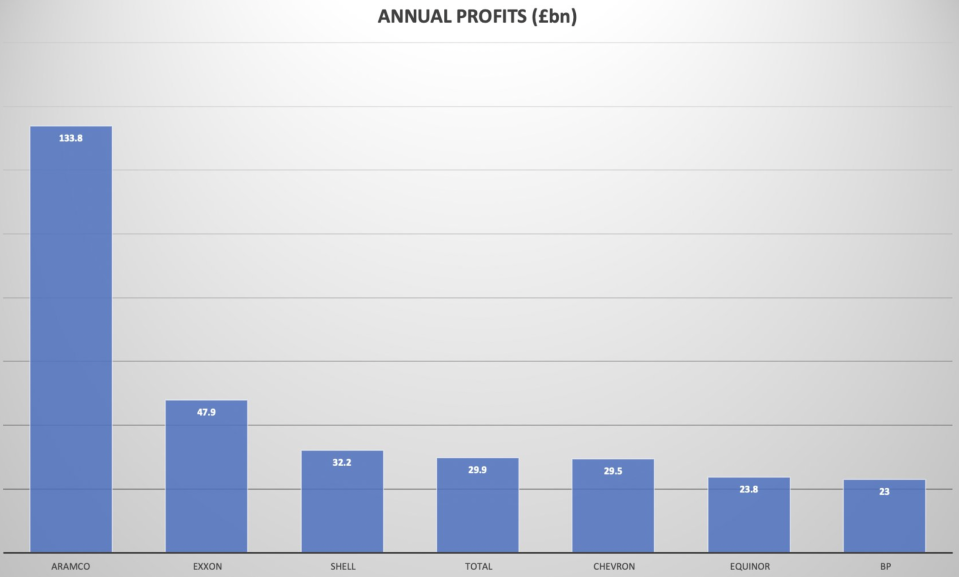

Saudi Aramco unveiled vast profits last week, the largest ever in the history of fossil fuel companies, dwarfing its rivals with a record £134bn full-year earnings.

Overall, its earnings were nearly treble the gains unveiled by Exxon Mobil, and four times more than Shell, Chevron, Total, BP and Equinor.

These companies had been posting their own record results, with Shell posting its biggest profits in its 115-year history, while Exxon announced the largest earnings ever posted by a Western fossil fuel major.

Such a hefty windfall from Aramco – a 46 per cent spike in profits since last year – from soaring oil and gas prices is not a surprise, and has been signposted every quarter by Aramco following Russia’s invasion of Ukraine.

After all, the energy titan is nearly entirely owned by the Saudi Arabian government and is home to the country’s oil supplies, with more than 270bn barrels within its reserves.

What is remarkable is it shows no major signs of pivoting to a greener future, and is targeting a further ramp up in oil and gas prices.

Aramco ramps up oil and gas spending

Aramco’s targets include a one million barrels per day boost in oil production from 12m to 13m over the next four years, and a 50 per cent hike in gas production by the end of the year.

This will be achieved through raising capital expenditure in fossil fuels from $37.6bn last year to $55bn this year.

The firm’s rivals are also boosting their own oil and gas spending plans and maintaining their role in the sector for multiple decades despite net zero pledges – while renewable spending lags far behind.

Looking at the UK players, BP chief executive Bernard Looney argued spending on both renewables and fossil fuels was an “and” not an “or” question, and has eased the company’s emissions targets.

The energy giant had previously promised its emissions would be 35-40 per cent lower by the end of this decade – but it is now targeting a 20-30 per cent cut, and plans a greater production of oil and gas over the next seven years compared with previous targets.

Meanwhile, new Shell boss Wael Sawan has warned that “cutting oil and gas production is not healthy” and implied the company’s plan to reduce output 1-2 per cent every year over this decade is now under review.

Heather Plumpton, policy analyst at environmental think tank Green Alliance, has criticised the lack of commitment from energy giants, which have all pledged to hit net zero goals – including Aramco.

She told City A.M.: “Oil and gas companies have made extraordinary profits during the gas price crisis. If they want to live up to their claims to be key players in the net zero transition, they should be investing those profits into the green technologies that will dominate the future energy system. Doubling down on last century’s technology and handing out huge shareholder payouts is economically short-sighted.”

Callum Macpherson, head of commodities at Investec, was more sympathetic to the quagmire energy firms found themselves in – struggling to attract green investors despite net zero goals, while also alienating ‘returns only’ investors that would otherwise back oil and gas firms.

He explained: “If you look at this from the point of view of investors – you’ve got some investors who are doing ESG screening and perhaps positive impact investing. This is where they not only want to invest in companies that don’t do harm, but they want to invest in ones that do actual good.

“Then you’ve got another sort of investor who is just looking at returns, perhaps through more conventional metrics and they want to see an oil company as being something that produces good returns – especially in this kind of market.”

BP faces activist challenge over climate goals

Andy Mayer energy analyst at free market think, the Institute of Economic Affairs, warned producers would only shift from renewables when a clear business case was made for making the transition – which was hard to find when fossil fuel demand was so robust.

He argued that while this contrasted with the energy sector’s net zero and green pledges, “dealing with reality matters more than consistency.”

“Without security of supply prices rise. If energy prices rise all activity including decarbonisation becomes more expensive and slows down. The companies deserve to be criticised for their prior incaution with words, not their current wisdom with new investments,” Mayer said.

The energy agenda of fossil fuel firms could be tested at BP’s AGM next month, where activist group Follow This are bringing forward a fresh resolution for BP to align its 2030 scope three emissions reduction plans over the current decade with the Paris Climate Agreement.

Mark van Baal, founder of Follow This, argued that “Paris-aligned voting has to regain momentum in 2023.”

He said: “BP’s reversal was a wake-up call for institutional investors, asset managers and pension funds. It will be up to major shareholders to get the company back on track.

“Investors have much more to worry about than the return on capital of oil majors. They have to worry about the returns of their entire portfolio in the global economy, and these are in great danger if the world fails to reach the goal of the Paris Accord.”

Aramco, BP and Shell have been approached for comment.