Aramco boss warns oil markets are still tight despite price slump

Oil markets remain tight, and investors should be focusing on the lack of global spare capacity to boost production rather than plummeting demand, argued Saudi Aramco’s (Aramco) chief executive.

The boss of the world’s biggest crude producer Amin Nasser argued current oil prices reflected a market overly-focused “on short-term economics,” with multiple developed economies expected to drop into a recession.

Speaking at the Energy Intelligence Forum in London, he said: “(The market is) focusing on what will happen to demand if recession happens in different parts of the world, they are not focusing on supply fundamentals.”

This included a general decline in spare capacity, which is typically defined as extra crude supplies that can be brought online quickly in case of supply shocks.

He estimated this was currently “extremely low”, at just 1.5 per cent of global demand.

Nasser feared this would be “completely eroded” if China relaxed its long-running Covid-19 restrictions and began to consume more supplies.

“If China opens up, [the] economy starts improving or the aviation industry starts asking for more jet fuel, you will erode this spare capacity,” he said.

“And when you erode that spare capacity the world should be worried. There will be no space for any hiccough — any interruption, any unforeseen events anywhere around the world.”

OPEC+ plan output cut to prop up oil prices

Nasser sounded the alarm over global capacity ahead of a key OPEC meeting tomorrow in Vienna, Austria.

The cartel, which is headed by Saudi Arabia, is weighing up a cut of over 1m barrels per day to bolster tumbling prices.

If agreed, this will be the group’s second consecutive monthly cut after reducing output by 100,000 bpd last month.

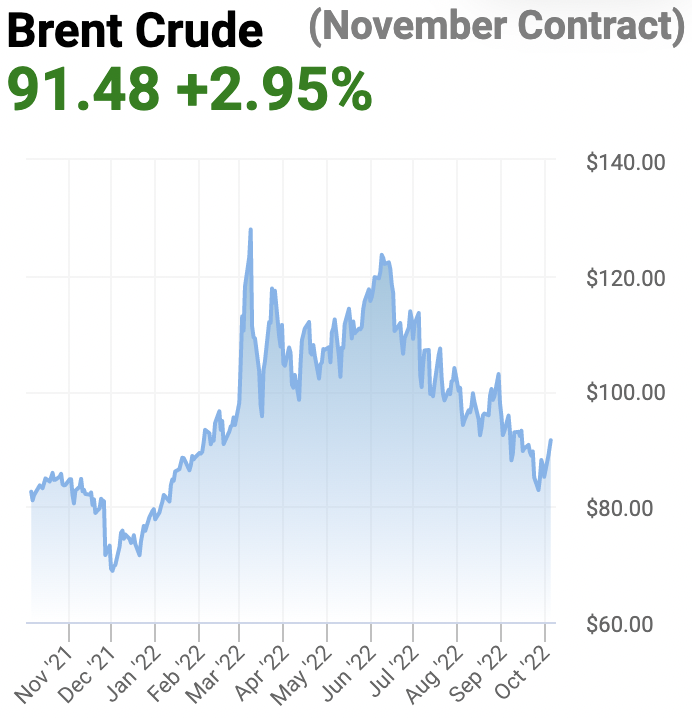

Oil has dipped from a 14-year high of $139 per barrel in March to around $90 per barrel across both major benchmarks.

On Tuesday evening, Brent Crude and WTI Crude were trading at $91.50 and $86.21 respectively.

Nasser’s comments follow months of OPEC and its allies, known as OPEC+, persistently failing to meet pledged hikes in production this year.

They have increased output this year, after record cuts were implemented in 2020 when the pandemic slashed demand.

However, the group has not managed to meet its planned output increases, missing its targets in August by 3.6m barrels per day.

The group has consistently pointed to underinvestment and spare capacity shortages for its failure to boost production, despite persistent calls from Western countries to ramp up supplies to ease and escalating cost of living crisis.

Saudi Arabia is also concerned Russian output could fall sharply later this year when western sanctions against the country’s oil exports kick in, creating a supply glut – with phase out plans across the EU and UK becoming reality.

Aramco overtook Apple this year as the world’s most valuable company, and the state-backed energy giant is in the process of raising its maximum production capacity from 12m barrels per day to 13m barrels per dat by 2027.

In August, the company smashed its quarterly profit record set in May, powered by soaring energy prices and chunky refining margins following Russia’s invasion of Ukraine.

It reported a massive 90 per cent rise in second-quarter earnings, surpassing analyst expectations.

The company’s net profit rose to $48.39bn for the quarter to June 30, up from $25.42bn in the earlier quarter.