APIs: the invisible wiring pivotal to digital transformation

Unless you work in a technology-focused business, or are particularly technology-minded, it’s unlikely that you will have heard of ‘Application Programming Interfaces’ – or APIs.

But as companies, and daily life, become increasingly technology-based – a trend accelerated by coronavirus – and APIs themselves evolve, they are becoming more important to business success. For an increasing number of companies, they are mission critical – the company could not exist without them.

So what are they? An API is a software intermediary that allows two machines to interact – to speak the same language. Even their advocates concede they are not inherently exciting. But a trend towards ‘open APIs’ (also known as public APIs) – APIs made publicly available to software developers – has changed the game.

“APIs have been around forever as a means of data migration and exchange allowing one piece of software to talk to another, but they were previously used in a closed or partner fashion,” explains Neil Ainger, a technology journalist specialising in banking and fintech. “What has been significant this past decade is the use of open APIs to power amalgamated services such as Uber – who access maps, payment functions and various other data sources via APIs – to serve their consumers. It’s the same with everything from weather-monitoring and restaurant-booking apps to rail timetables.”

“APIs are really coming to the forefront”

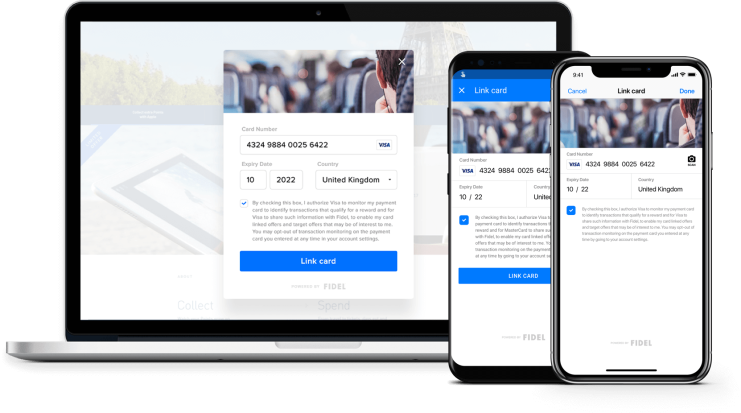

Dev Subrata is founder and chief executive of Fidel API, a London-headquartered software firm whose mission is to ‘democratise access to payment data, globally’.

Subrata tells City AM: “APIs are really coming to the forefront as so many technology innovators are building all sorts of different products that create more holistic experiences for consumers, informed by real-time data via various APIs.”

“Open APIs mean that the speed of innovation is massively accelerated because barriers to entry are being removed. The flipside is that companies are then reliant on other services to function,” he says.

Ainger and Subrata both identify ‘open banking’ – established banks opening up their APIs to enable third parties to access financial information and develop new apps and services – as a development that highlights the benefits of open APIs.

The organisation leading the UK’s open banking journey is the Open Banking Implementation Entity (OBIE). Its ecosystem development director, David Beardmore, describes APIs as “the secure, invisible plumbing that help transmit data securely and enable so much of our connected life”.

“The way open banking works, using APIs, is that you give permission to another organisation, such as a fintech, to be able to securely access your financial information, which in turn can unlock better, more personalised products and services based on what you actually spend,” Beardmore explains. “This could help, for example, people qualify for a wider range of loans or mortgages by making it easier to share their banking history, or enable small businesses access to alternative sources of credit.”

More than one million people have now used open banking in the UK. “If you donated to Captain Tom Moore’s fabulous NHS fundraising effort via JustGiving, it’s possible the method you used was powered by open banking,” says Beardmore.

Within financial services, open APIs are also having their time in the sun in the insurance industry. “As the insurance sector works its way through the new normal, its API hour is finally here,” Tony Grosso, US-based head of marketing at EIS Group, tells City AM. “APIs are accelerating much-needed changes in the insurance sector, which will make customers happier because they are receiving more personalised ‘quote-to-bind’ services. APIs are also allowing insurers to cleverly use internal and external data to modernise front- and back-end operations without having to invest in full technology infrastructure overhauls.”

“Unsung hero of technology”

Back in the tech sector, Daria Kepa-Green is marketing director at Appvia, a London-based software firm. She describes APIs as “an unsung hero of technology”, and concurs that open APIs have begun to gain public recognition through developments such as open banking.

But she also points out that a trend towards firms moving to the ‘Cloud’ – software run through online datacentres, managed by Cloud vendors as opposed to datacentres that companies themselves own – is also facilitated by APIs.

Subrata agrees, explaining how the Cloud is an integral part of the API growth story. “All the big Cloud infrastructure services – Microsoft Azure, Amazon Web Services, Google Cloud – are accessed by millions of companies around the world thanks to powerful APIs. These Cloud services now form the core infrastructure for many of the services we consume today,” he says.

The increasingly digital future is only going to increase further the importance of APIs, even though consumers wouldn’t necessarily know (or need to know) the ‘tech behind the tech’: the invisible wiring powering the so-called ‘Internet of Things’ in which everything connects.

“APIs will underpin a future in which, say, your fridge knows you are running out of milk and automatically places an order for new milk, and pays for it,” says Subrata.