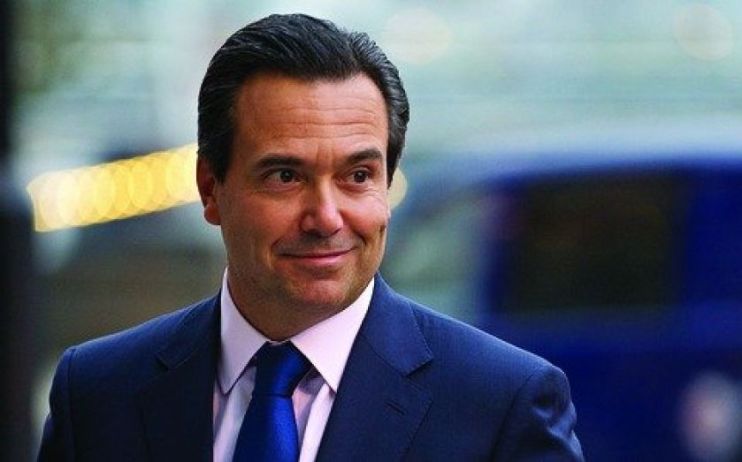

Antonio Horta-Osorio signs off at Lloyds with a £1.4bn post-tax profit

Lloyds bank posted a £1.4bn after tax profit for the first quarter, up nearly 200 per cent on the same time last year, in boss Antonio Horta-Osorio’s final results at the helm.

The banking giant’s statutory profit after tax for the three months to 31 March 2021 was £1.39bn compared to £480m this time last year.

Pre-tax profit for the period was £1.9bn, well ahead of ananlysts expectations of £1.3bn.

Lloyds’ (LLOY) share price was up around 4.3 per cent soon after the market opened following the positive results.

Lloyds Banking Group was boosted by the release of a £459m chunk of its provisions for expected bad loans due to the pandemic, with a net improvement of £323m, compared to a forecast of £357m of additional impairments.

These will be the last results overseen by Credit Suisse-bound Horta-Osoria, who led the bank back out of partial state ownership and departs at the end of this month.

He said: “It is with both pride and sadness that I will step down as group chief executive later this month. Most importantly, the Group is well placed for sustainable success and the publication of Strategic Review 2021 in February shows that the Group has clear execution outcomes for 2021, underpinned by long-term strategic vision”.

At a press conference this morning, the outgoing chief said his Lloyds highlight was the day the bank was told by the Treasury that the government had sold its final shares, “we quickly put everyone online and I congratulated everyone for returning taxpayer’s money, that was a high moment,” he added.

In terms of lowlights, when Horta-Osoria started at the bank, in the aftermath of the financial crisis, the bank was in a precarious position. He said he was not able to speak about the situation at the bank, which made the situation worse, ultimately leading to him having to take a few weeks away from work due to exhaustion.

Changing working patterns

In wake of pandemic-led changes to working practices, Lloyds has added itself to the list of companies making permanent changes to working patterns.

The bank surveyed staff and found most wanted some sort of hybrid model going forward, where they were able to work from home some of the time, and head into the office some of the time.

The chief executive said staff had been just as productive at home, and as a result hybrid working will continue and the office will be used as more of a collaborate space, where staff can book space, should they want to go into work.

Pleasing progress

Richard Hunter, head of markets at Interactive Investor, said Lloyds was seeing the benefit of the rising tide of sentiment in the UK, and its numbers reflected a recovery play in action.

“Overall, Lloyds will be pleased with the progress it is making, particularly with regard to those factors within its control. The share price has also seen the benefit of its improving fortunes, having added 43 per cent over the last year, as compared to a jump of 17 per cent for the wider FTSE100,” he said.

“Recent momentum is similarly strong, with a 59 per cent spike since the announcement of the vaccine in early November. With a steady hand on the tiller, the bank remains well regarded by investors, and the market consensus of the shares as a buy will likely remain intact following this update.”