Ant Group gets final approval for world’s biggest stock market float

China’s Ant Group today won the final nod from regulators for its $35bn (£26.6bn) initial public offering, clearing the way for what could be the largest-ever stock market debut.

The fintech giant, which is backed by Chinese ecommerce group Alibaba, today won approval from the country’s top securities watchdog for its registration in Shanghai.

Ant is planning to list simultaneously in Hong Kong and Shanghai, with the deal expected to take place in the coming weeks.

The listing is likely to be the largest ever, topping the record set by Saudi Aramco’s $29.4bn float last December.

Ant is set to conduct price consultations for the Shanghai listing on 23 October and will set the price on 27 October, according to its prospectus.

The company is likely to try to push ahead with the float ahead of the US presidential election on 3 November due to potential market volatility following the results.

The payments firm aims to split the share offering equally between Hong Kong and Shanghai, selling up to 1.67bn shares on each bourse.

The prospectus showed that strategic investors will account for 80 per cent of the domestic float. This includes Tmall, a subsidiary of Alibaba, which has committed to purchasing 730m shares.

It comes two days after Ant won approval from the Hong Kong Stock Exchange for the offshore part of its float.

Ant, which is China’s largest mobile payments firm, reported an operating income of 118.2bn yuan (£13.5bn) in the nine months to September, up 42.6 per cent from year earlier. Nine-month gross profit rose 74.3 per cent to 69.5bn yuan.

After initial feedback from investors, Ant upped its offering size from $30bn to $35bn, targeting a valuation of $250bn, Reuters reported.

If completed, the IPO would mark a major boost for Hong Kong and help to cement its status as one of the world’s leading capital markets hubs.

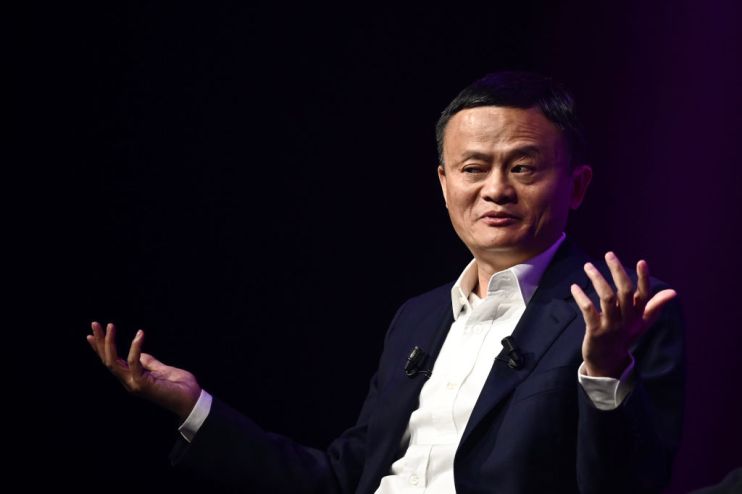

The listing is also expected to provide a bumper payday for Alibaba co-founder and China’s richest man Jack Ma, who has a net worth of roughly $60bn.