Ant Financial takes minority stake in fintech unicorn Klarna

The highest valued fintech company in the world, Ant Financial, has taken a minority stake in payments platform Klarna.

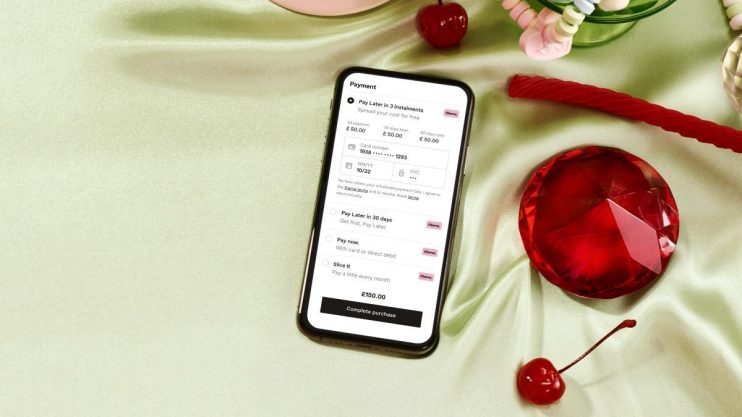

The “buy now pay later” specialist confirmed that Alipay owner Ant Financial had bought a less than one per cent stake, but refused to disclose how much it is worth.

Ant Financial is part of the Chinese ecommerce giant Alibaba Group. The pair had already been collaborating via Alibaba’s global ecommerce marketplace, AliExpress, which offers Klarna’s “pay later” option.

In a statement Klarna’s chief executive Sebastian Siemiatkowski said: “At the heart of this cooperation between Klarna and Alipay is a shared ambition of innovating truly superior shopping experiences and creating destinations of inspiration for consumers across the world.”

Sign up to City A.M.’s Midday Update newsletter, delivered to your inbox every lunchtime

“We are delighted in this confidence shown in Klarna in defining the future of payments and shopping and are very much looking forward to working together further in the future.”

Last week the Swedish-based fintech startup posted its first ever annual loss as its credit losses more than doubled during 2019 to 1.86bn Swedish krona.

It had previously enjoyed the rare status of being a consistently profitable fintech, in part because of deals with retailers like Asos and Ikea.

A Klarna spokespeson reiterated chief executive Sebastian Siemiatkowski’s comments earlier this week which emphasised that Klarna has no ambitions to enter into the Chinese market at present.

He told Reuters: “The US is often used as a benchmark of what it means to be competitive but in my world it just does not compare to the Chinese one.”

“The level of innovation there is just tremendous, especially in app retail and payments – they are the global pace setters. For Klarna, there is much more opportunity in other markets.”

Get the news as it happens by following City A.M. on Twitter.