Andrew Bailey hints Bank of England is close to ending interest rate hike cycle

Andrew Bailey has hinted that the Bank of England will stop hiking interest rates soon in an interview today.

Speaking to Business Live, the governor of the Bank suggested market expectations of rates peaking at around 4.5 per cent is more in line with the central bank’s own thinking.

Though Bailey, 63, said he is “not endorsing 4.5 per cent,” he pointed out that the Bank chose to not send another warning to investors about their forecasts for borrowing costs “being in our view rather out of line”.

He said the need to push back against investors’ rate bets has retreated since the financial market chaos that was triggered by Liz Truss’s mini budget.

Investors ratcheted up their bets on interest rates peaking at around six per cent in the weeks after Truss’s September mini budget, where she launched £45bn worth of unfunded tax cuts, including ditching the top rate of income tax.

Coupled with the government spending billions on capping energy bills at £2,500 – which will rise to £3,000 in April – her decisions set UK borrowing on a steep upward path, spooking investors.

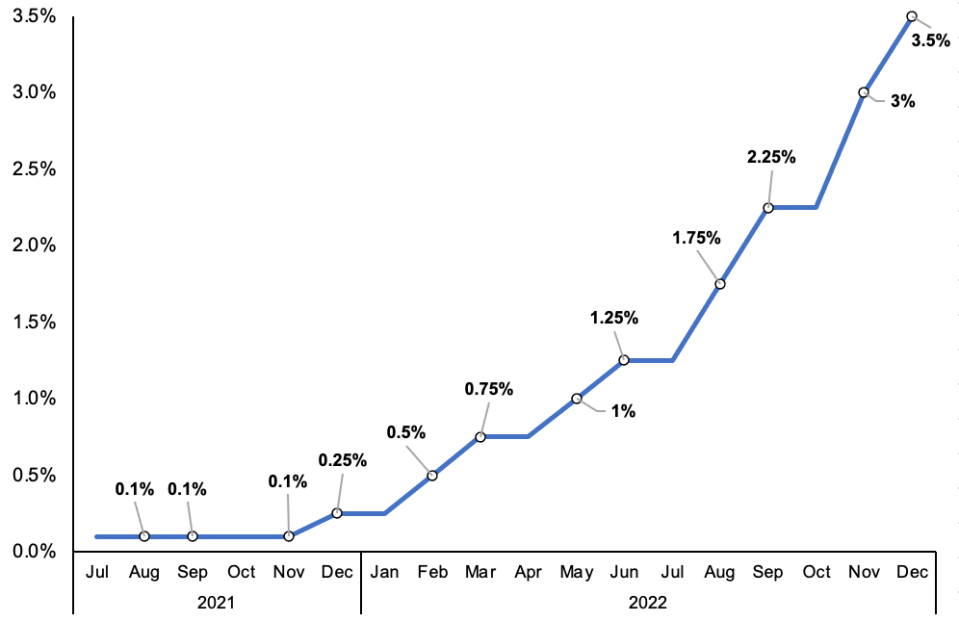

Bailey and co have kicked interest rates higher nine times in a row…

The pound plummeted to its lowest level ever against the US dollar and UK debt costs climbed to two decade highs after the statement on 23 September.

The Bank revealed last week it made £3.8bn in profit after ditching the around £20bn it hoovered up under the programme, money which will flow back to the government.

A big upward move in rate expectations forced the Bank in its November monetary policy statement to take the unusual step of telling markets to rein in their bets.

“The majority of the committee judges that, should the economy evolve broadly in line with the latest Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets,” the Monetary Policy Committee (MPC) said.

Rate expectations have since climbed down to around 4.5 per cent, due to a combination of now chancellor Jeremy Hunt canning pretty much all of Truss’s mini budget and committing to getting the debt pile down.

Bailey’s nod to the rate setting committee feeling more at ease with the market’s projections signals it is closer to the Bank’s own thinking.

He and the rest of the MPC will announce their next interest rate decision on 2 February.

Analysts, however, are divided over whether they will opt for another 50 basis point increase, taking rates to a post-financial crisis high of four per cent, or a 25 basis point move.

The Bank has lifted borrowing costs nine times in a row, the most aggressive tightening cycles since it was made independent in the late 1990s.

While another hike is almost certain next month, Bailey’s comments suggest the Bank will stop lifting rates when they hit somewhere between four and 4.5 per cent.

The Bank has lifted borrowing costs nine times in a row, the most aggressive tightening cycle since it was made independent in the late 1990s.

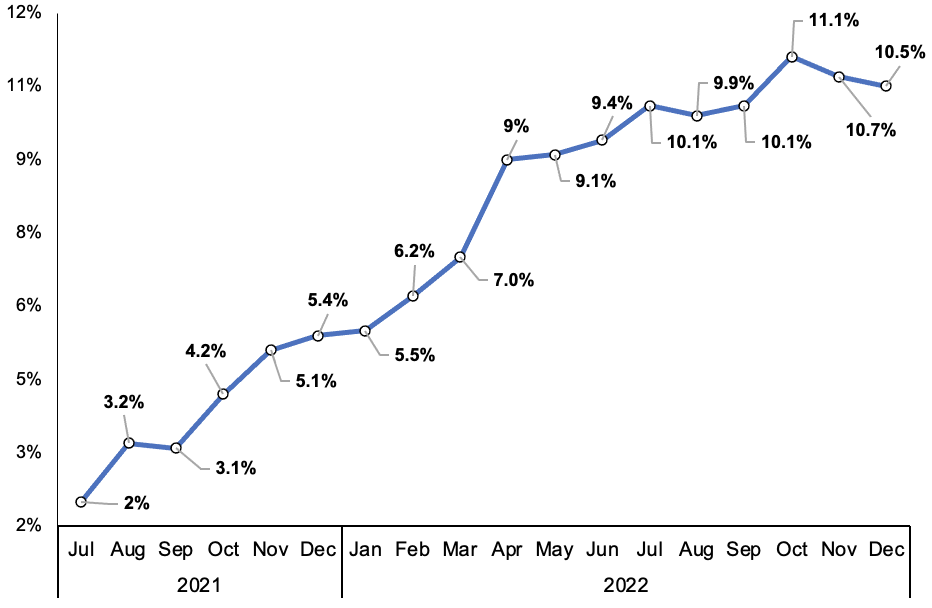

Inflation has raced to 40-year high of 10.5 per cent, but has fallen two months in a row, the ONS said this week, raising hopes it will gradually fall this year. If it does, the need for more rate rises to curb spending will ease.

… to tame scorching inflation

This week’s ONS numbers signalled “the beginning of a sign that a corner has been turned,” Bailey said, although he added a recession is still likely.

The Bank’s own forecasters think inflation will halve by the end of the year, but they routinely undershot the strength of last year’s price rise surge.

Bailey and co are worried they could hurt households and businesses by lifting interest rates too much.

Monetary policy operates with a lag, so it is tough for central bankers to know exactly when to end a rate hike campaign.