Andrew Bailey, Christine Lagarde and Jerome Powell warn inflation fight not yet done

Andrew Bailey and the cream of the global central banking crop today warned they may need to keep heaping pressure on the global economy before they can declare victory over high inflation.

Speaking at the European Central Bank’s (ECB) annual monetary policy conference in Sintra, Portugal, the chiefs of the Bank of England, Federal Reserve and ECB signalled that their respective campaigns to ease price pressures still have legs to run.

Bank governor Andrew Bailey said the drag on the UK economy from high inflation would be a “worse outcome” than the hit from higher borrowing costs.

He added that stronger than expected wage growth and price rises meant he and the rest of the nine-strong monetary policy committee (MPC) last Thursday “had to make really quite a strong move”.

MPC officials voted 7-2 in favour for a 50 basis point increase to the UK’s official interest rate, taking it up to a near 15-year high of five per cent.

ECB president Christine Lagarde said she and the rest of the governing council are “very likely [to] hike again” at the eurozone central bank’s next meeting in July

And Jerome Powell, head of the Fed, the world’s most influential central bank, said policy “may not be restrictive enough and it has not been restrictive for long enough”.

Powell said the Fed has not been in restrictive territory “very long,” adding that the Fed will be a squeeze on the American economy for as long as “we need to be”.

The trio’s remarks indicate central banks intend to keep interest rates at their peak for an extended period of time to make sure high inflation doesn’t return – known as a “higher for longer” strategy.

Monetary authorities are at a crossroads after more than a year of jacking up borrowing costs from rock bottom lows, embarking on the quickest tightening cycles in recent history.

Experts think they are in the final leg of their respective rate hike campaigns, with the Fed and ECB expected to lift rates 25 basis points two more times this year. Such moves would take US rates to a range of 5.5 per cent and 5.75 per cent and European rates to four per cent.

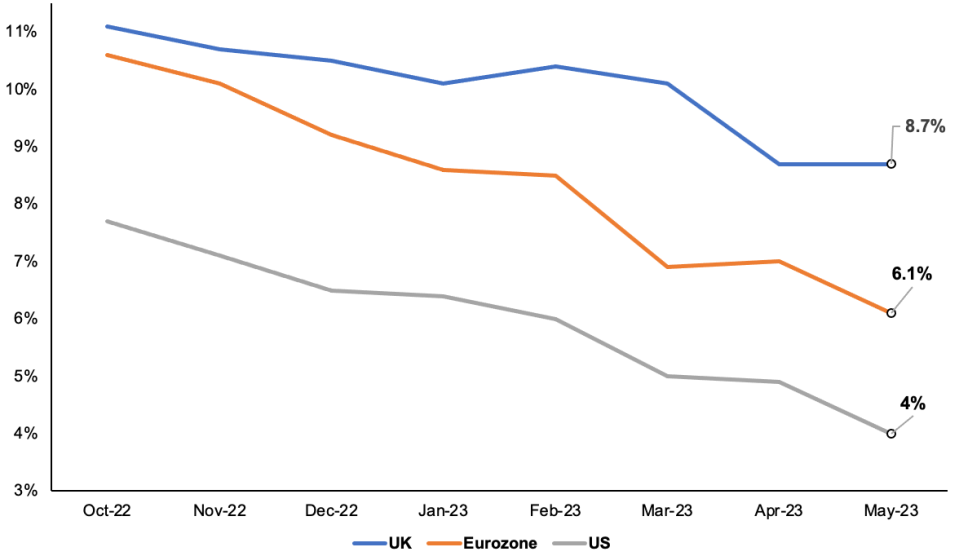

UK, US and eurozone headline inflation rates

However, the Bank is under greater pressure to strain the UK economy further despite already lifting borrowing costs 13 times in a row to five per cent, the highest level in 15 years.

Financial markets think Bailey and the rest of the MPC could repeat last week’s bumper 50 point rate rise in August and eventually send rates to a peak of more than six per cent, a level not reached since 2000.

Britain has the highest inflation rate in the rich world, compelling traders to price in the Bank hoisting interest rates to the steepest level in the G7.

The Bank, Fed and ECB are supposed to keep inflation at two per cent.

Scorching core inflation of more than seven per cent and services prices climbing 7.4 per cent signals UK price pressure are now being led by domestic factors, which typically require further interest rate rises.

Core inflation is still elevated in Europe and the US, which Powell and Lagarde have acknowledged will require further monetary tightening.

Bailey noted the speed at which the Bank’s interest rate rises emerge in the economy has slowed due to more homeowners opting for fixed-rate instead of floating rate mortgages since the 2008 financial crisis.

“History isn’t gonna be a great guide for that given the change in the [mortgage] market,” he said.

Economists are concerned the Bank will hobble family and business finances too much and throw the UK into a recession. Others have argued a recession is necessary to bring inflation back to the two per cent target.

Some 1.4m homeowners over the next 12 months are poised to have 20 per cent of their disposable incomes wiped out when they remortgage on to a contract with a much higher rate, according to the Institute for Fiscal Studies.

Bailey said he “understands” why people have slammed the Bank for allowing inflation to get out of hand and not forecasting the strength of price pressures accurately.

Earlier today, at the same conference in Sintra, Huw Pill, Threadneedle Street’s chief economist, said the central bank’s forecasting models have been “unworkable” amid the series of economic shocks the UK has suffered.