Andreessen Horowitz backs London insurance start-up to shrug off UK venture woes

Silicon Valley giant Andreessen Horowitz (a16z) has thrown its weight behind London insurance tech Hyperexponential today in a deal that shrugs off the gloom gripping the UK’s venture capital market.

In a statement this morning, Hyperexponential, which uses so-called “pricing decision software” for insurance deals, said it had bagged £57m ($73m) in a series B round led by US venture firm Battery Ventures, with backing from Andreessen Horowitz.

Hyperexponential serves insurance and reinsurance companies in the multi-trillion-dollar global property-casualty insurance industry, allowing firms to shield themselves from risks like climate change, geopolitical unrest and cyberterrorism. The start-up counts major firms like Aviva and HDI among its client base.

Boss and co-founder of Hyperexponential, Amrit Santhirasenan, said the ‘insurtech’ outfit was now looking to ramp up its growth into the US with a New York office set to open this year.

“The insurance industry is at the forefront of a rapidly changing world and must find ways to understand and respond to that change in risk profile,” he said in a statement.

“Although we have more cash-on-hand than we’ve raised, we wanted to bring on new expertise in our target markets as we continue our growth into new verticals and geographies.”

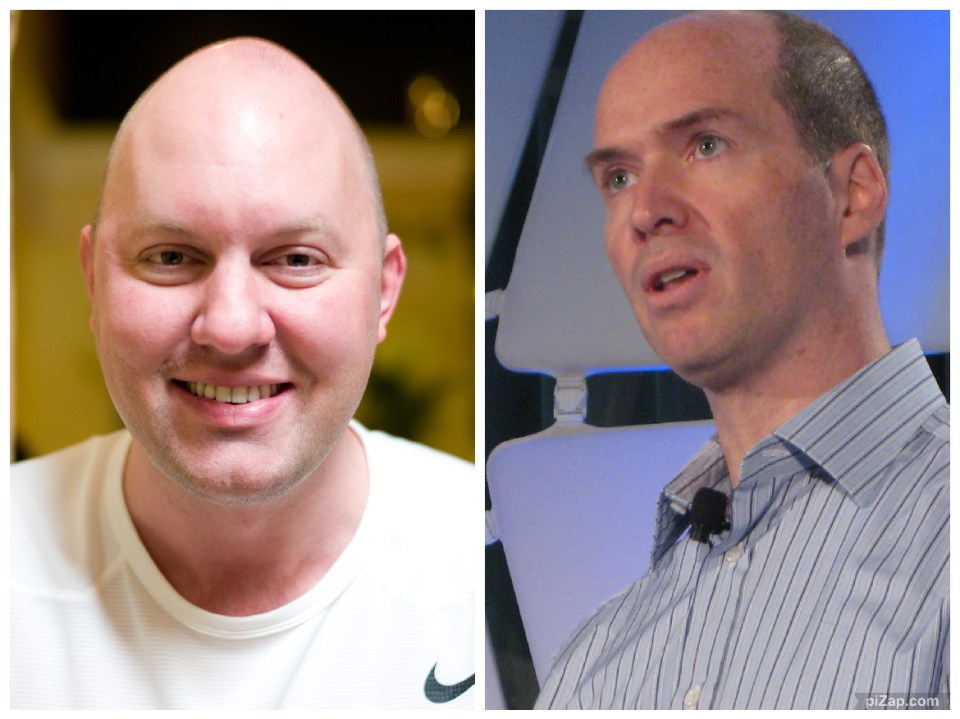

The firm declined to say what valuation the round placed on the firm. Battery Ventures’ Marcus Ryu, and Adreessen Horowitz partner Angela Strange are now set to join the company’s board.

The deal comes amid a slump for the UK’s venture capital market as rising interest rates and economic downturn choke off the flow of cash into the country’s tech start-ups.

UK venture capital funding cratered by almost half last year to £16.1bn in 2023 from £28.9bn the year prior, according to preliminary data from Pitchbook, compiled for City A.M. last week.

Fintech trade body Innovate Finance said separately the UK sector received £4bn ($5.1bn) of investment in 2023, down 65 per cent from 2022, in line with other countries.