Analysts call for Blinkx to sell up after second profit warning hits

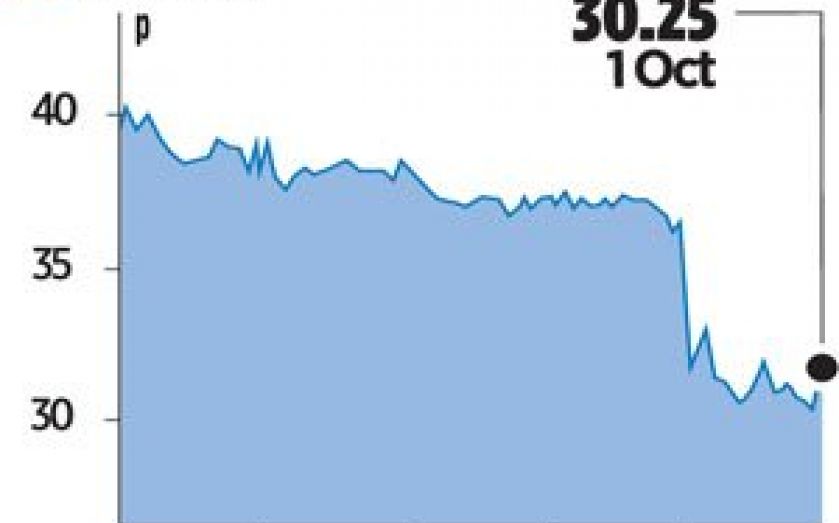

VIDEO search and advertising group Blinkx should sell up to a corporate buyer and return cash to shareholders, analysts said yesterday, after the group issued another profit warning sending shares plummeting.

Nearly 13 per cent of Blinkx’s value was wiped off after the firm reported its earnings before interest, taxes, depreciation, and amortisation (EBITDA) for the first half of the year would be zero, compared to $18m (£11.1m) last year.

Meanwhile, revenues were forecast to be between $102m and $104m, below market expectations.

“Historical EBITDA multiples look attractive but [downward] profit momentum is alarming. That being said, investors will be aware of the cash in the business, together with still-impressive revenue scale. Common sense dictates to us that Blinkx must have some attraction to a corporate buyer,” said Peel Hunt analyst Alex DeGroote.

Blinkx first shocked investors in July by warning that its first-half earnings would be $5m lower than management expectations, causing its shares to lose more than half of their value.

The Aim-listed company blamed industry-wide issues around the efficiency and effectiveness of online advertising, as well as a lingering slide in demand following a disparaging blog on Blinkx’s business practices. An associate professor at Harvard Business School had posted a blog alleging the firm used “deceptive tactics” in January.