Analysis: UK more bullish on energy sanctions with EU’s Russian dependency raising supply fears

The West has ramped up its sanctions against Russia, excluding multiple Kremlin-associated banks from the SWIFT payment system and imposing restrictions on the country’s central bank.

“We will hold Russia to account and collectively ensure that this war is a strategic failure for Putin,” said the leaders of the European Commission, France, Germany, Italy, Britain, Canada and the US.

However, the Western response to Russia’s invasion of Ukraine has continued to avoid energy sanctions, as such measures could prevent Europe purchasing crucial supplies from the country.

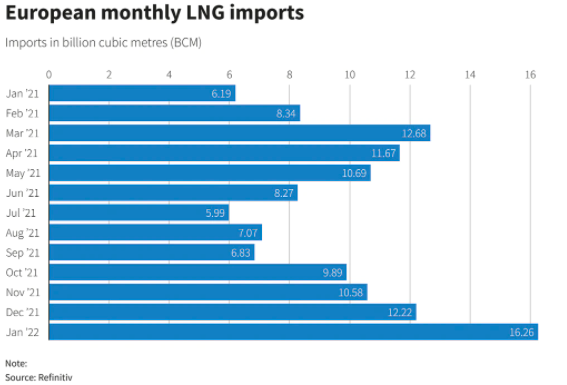

The EU relies on Russia for around 40 per cent of its natural gas, with the trading bloc staving off which staved off blackouts through a fortunate combination of milder winter weather and eleventh hour top-ups in liquefied natural gas – chiefly from the US.

While German Chancellor Olaf Scholz made the bold call to suspend the Nord Stream 2 approval process, the continent is still “mainlining Russian hydrocarbons” as described by Prime Minister Boris Johnson.

High costs will hit everyone regardless of supply problems

Russia has so far remained committed to supply gas to world markets, and Europe has reciprocated with its commitment to buying supplies.

The long term plan may be to divest through a mixture of renewable investing and boosting its own LNG facilities, but for the mean time: its dependence on natural gas remains a key weak-spot in its sanctions agenda.

By contrast, Foreign Secretary Liz Truss has called for import limits to natural gas supplies from Russia – with the UK able to take a bolder stance, due to greater security in its supplies.

The UK is only reliant on Russia for four per cent of its natural gas, with no pipelines between either country.

Instead, it is chiefly boosting its stocks through North Sea production – which makes up 50 per cent of its supplies- and deals with Norway.

It also makes LNG agreements with Qatar, the US, and Trinidad and Tobago.

While it is looking to move on from fossil fuels, and bolster its energy suppliers through vast renewable projects – such as the world’s largest wind farm in Dogger Bank – its relative security in transitional energy sources such as natural gas that have enabled the UK to feel more secure in pushing for energy sanctions.

However, while the UK does not have the same supply fears as Europe and has pressed ahead for tougher sanctions, it is still vulnerable to market shocks and the crushing realities of high prices, which are already exacerbating a cost-of-living crisis in the UK.

Gas is a global market, meaning shortages and supply difficulties in one region effect prices everywhere.

The fossil fuel also remains a key part of the energy mix, and consequently still has a significant effect on power prices.

Therefore, prices are likely to go up across all developed economies in the coming months, amid rebounding post-pandemic demand and supply disruption following Russia’s invasion of Ukraine .

As a reflection of this new reality, fears of European supply shortages following Russia’s invasion of Ukraine saw natural gas prices soar over 50 per cent on Thursday on across the UK and Europe.

While prices have since dipped, gas remains historically high on both Dutch TTF Futures and UK Natural Gas Futures benchmarks.

Meanwhile, elevated prices combined with the poorly conceived consumer price cap – has seen market carnage escalate across the UK energy industry.

So far, 29 suppliers have collapsed since August, directly affecting over four million customers, with Bulb Energy falling into de-facto nationalisation and the price cap being hiked by 54 per cent.

This means household bills will rise to over £2,000 per year from April, with Investec gloomily forecasting the conflict in Ukraine could see it lifted to £3,000 from October.

Oil prices have generally risen in line with the spikes in gas prices, with the Brent Crude benchmark breaching $100 per barrel for the first time in eight years, which has seen petrol prices reach record highs, closing in on an eye–watering 150p per litre.

There is also the question of storage, with the UK’s gas storage generally lower than developed European economies, which could mean Liz Truss’ confidence in energy sanctions could be an overestimation.