Analysis: This shapeshifting inflation surge ain’t over yet

Today’s inflation figures may have caused a few chairs to be flung at walls in the Bank of England.

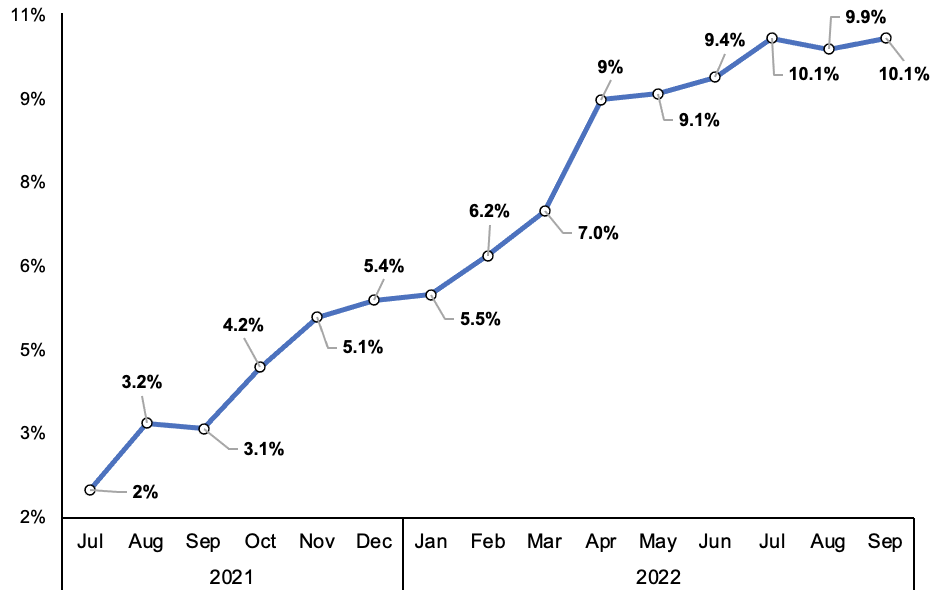

Prices are up 10.1 per cent over the year to September, above the City’s expectations and up from August. They were in line with the Bank’s forecasts though, a genuine rarity.

Remember, the central bank has lifted interest rates seven times in a row, including two-back-back 50 basis point hikes, to 2.25 per cent.

Before the August meeting, the Bank had never lifted borrowing costs by that amount since it was made independent in the 1990s.

Core inflation, which strips out products that undergo volatile price moves and captures goods and services that can lead to sticky inflation if their prices stay high, climbed to 6.5 per cent last month, the biggest jump in 30 years.

Over the month, it increased 0.6 per cent, also hotter than the Bank would like.

There are early signs that the inflation profile is re-shaping from being mainly driven by soaring energy costs to businesses hiking prices and workers receiving big pay rises.

That is entirely rational. Firms are geared toward protecting their margins by passing on higher costs, while consumers need to shield their living standards by demanding pay rises.

Annual UK CPI inflation

Those pay rises are not tracking inflation, indicating it is not wages that have changed the inflation profile, but higher logistics and energy costs.

There is a compelling argument for inflation eventually falling (but not for over a year or so).

The economy is headed for a tough period. Spending looks set to cool, both from businesses and households as a result of higher prices squeezing finances.

Higher mortgage rates caused by Liz Truss’s botched mini-budget has worsened the spending outlook.

A recession should increase unemployment, reducing demand and, in theory, inflation. Businesses are likely to struggle to keep raising prices if Brits are more cautious.

Inflation expectations remain reasonably well anchored due to people expecting that scenario to play out.

But, the Bank of England’s job ain’t done yet. More and bigger rate rises are coming, with a possible 100 basis point rise on 3 November.

This inflation surge has effectively put an end to a decade-long monetary policy cycle of ultra low rates.