American private equity firm to snap up Darktrace for £4.3bn

American private equity firm Thoma Bravo has struck a $5.3bn (£4.3bn) deal to buy British cyber security company Darktrace in an all-cash transaction.

The boards of directors of both companies have endorsed the deal but shareholders will have to approve it.

Shares in the London-listed firm soared over 19 per cent immediately following the news.

Under the terms of the acquisition, each shareholder of Darktrace will receive $7.75 (620p) for every share they hold, marking a substantial premium on Darktrace’s recent stock performance.

This premium represents a 44.3 per cent increase over the three-month average share price prior to the announcement.

Darktrace’s board believes that the company’s operating and financial achievements “have not been reflected commensurately in its valuation”, with the shares trading at a “significant discount” to its global peers.

It said the acquisition offer provides shareholders with the chance to receive a fair value for their shares in cash.

Gordon Hurst, the chair of Darktrace, said: “The proposed offer represents an attractive premium and an opportunity for shareholders to receive the certainty of a cash consideration at a fair value for their shares.

“The proposed acquisition will provide Darktrace access to a strong financial partner in Thoma Bravo, with deep software sector expertise, who can enhance the Company’s position as a best-in-class cyber AI business headquartered in the UK.”

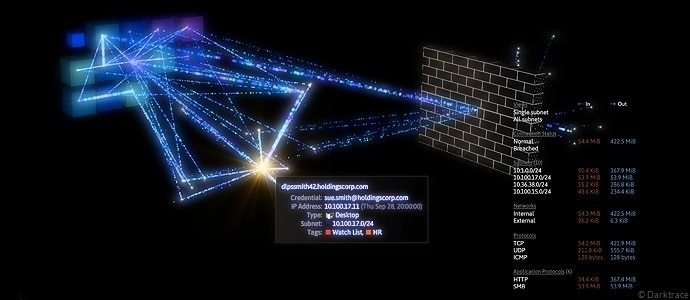

Darktrace, which uses artificial intelligence (AI) to improve companies’ cyber defences, has seen a surge in demand for its services, leading it to upgrade its revenue forecast for the full financial year 2024.

Peel Hunt analyst Charles Hall told City A.M. that the potential takeover of Darktrace should be a proper wake-up call to the government.

“This is our leading tech company being acquired by US private equity,” he said. “We now have 21 companies being bid for of which 12 are in the FTSE 350 and amounting to £57bn leaving the UK market.

“Add the £38bn from companies listing overseas (eg Flutter) the total is over £100bn. The UK market has an existential crisis and needs urgent action to ensure it remains a leading listing venue. This includes removing stamp duty to restore competitiveness, pension reform to encourage home investment and a British ISA to stimulate retail investment in the UK,” he added.

If the deal is approved by the majority of shareholders, it is currently expected to complete during the third or fourth quarter of 2024.

Andrew Almeida, Partner of Thoma Bravo, said: “Darktrace is at the very cutting edge of cybersecurity technology, and we have long been admirers of its platform and capability in artificial intelligence. The pace of innovation in cybersecurity is accelerating in response to cyber threats that are simultaneously complex, global and sophisticated.

“Darktrace is driven by a culture of innovation and we are excited by the opportunity to work alongside Darktrace’s team and accelerate its development into a scaled, global leader, further strengthening its capability and offer to customers.

“Thoma Bravo has been investing exclusively in software for over twenty years and we will bring to bear the full range of our platform, operational expertise and deep experience of cybersecurity in supporting Darktrace’s growth,” he added.

Thoma Bravo is one of the largest software-focused investors in the world, with over $138bn in assets under management as of December 2023.