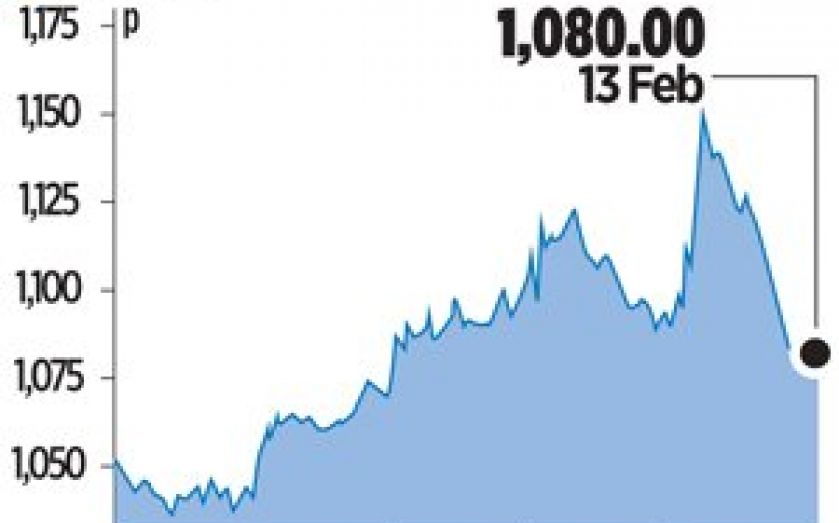

Amec rises on Foster Wheeler bid

ENGINEERING firm Amec plans to issue $800m (£481m) notes this year to part-finance its acquisition of Foster Wheeler, as it said yesterday that it had made a definitive $3.3bn offer for its US rival.

The FTSE 100-quoted company could still be usurped by a rival bid, but chief financial officer Ian McHoul told City A.M. that they “feel confident the deal will happen”.

Amec has lined up half of the financing needed from Bank of America Merrill Lynch, Barclays, RBS and Bank of Tokyo Mitsubishi. The rest will come from a corporate bond of around $800m, which may be in a number of tranches and currencies.

“We haven’t needed to issue a bond before as we had net cash on our balance sheet, but now we need the debt,” McHoul said.

The acquisition, which is expected to be double-digit earnings accretive in 12 months, is forecast to close in the second half of the year.

Amec unveiled full-year results broadly in line with expectations, with earnings up three per cent to £343m. Shares fell 1.1 per cent.