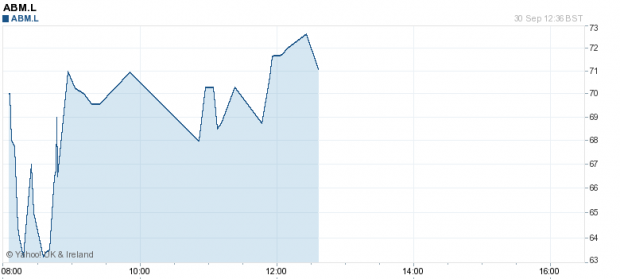

Albemarle and Bond shares slump on profit warning and £35m rights issue

For pawnbroker Albemarle and Bond, things have gone from bad to worse after its share value crashed this morning, following their announcement of an emergency rights issue of £35m and profit warning.

City A.M.'s Michael Bow reported this morning:

TROUBLED pawnbroker Albemarle & Bond is in the market for an emergency bailout after its business was hit by a slide in the price of gold.

The company, which has more than 200 stores and is listed on the junior stock market in London, is understood to be close to securing the funds to keep it alive after tapping existing investors for cash.

Albemarle & Bond is the UK’s second largest pawnbroker but a double digit plunge in the price of gold, which is a mainstay of its broking business, has taken the shine off its earnings.

Brokers predict earnings will fall 25 per cent for the full year in 2013 and a further 15 per cent in 2014.

The company revealed discussions to raise £35m through a new shares issue in order to deal with rising debts, which currently stand at £51m. It also warned it was at risk of breaching loan covenants as the falling price of gold sees profitability slide.

The falling price of gold over the past nine months – a response to fears of an early curtail to the US Fed's stimulus programme – has, Albemarle and Bond said, created uncertainty for the current financial year.

The results are late being published – they were due to report its full results last week.

This is not the first pothole for the company which, back in April, issued a profit warning and saw the resignation of its CEO, Barry Stevenson.

Shares are currently down 44.45 per cent at 71.10.