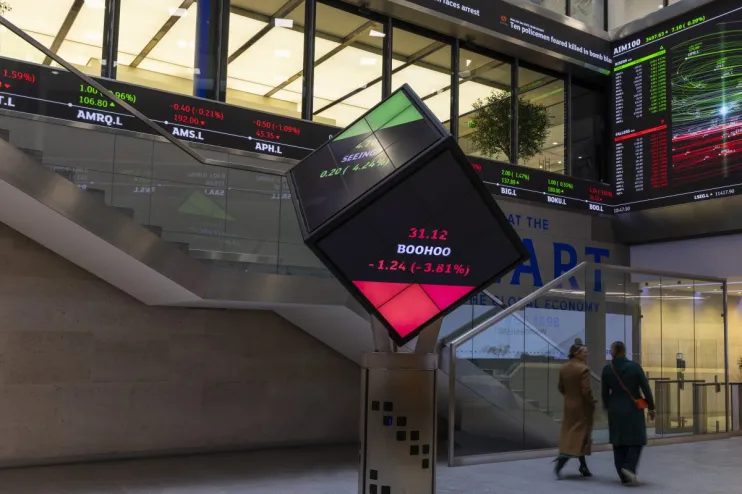

AIM IPOs: What happened this week on London’s junior stock exchange?

After AIM started the week strong with the announcement of two planned IPOs, London’s junior stock market has seen more companies float on its exchange.

This week, AIM had two IPOs, One Health Group and Wellnex Life, compared to the 11 which pursued an IPO throughout the entirety of last year.

One Health Group, a provider of NHS-funded medical procedures, joined AIM from Aquis yesterday, though it has had limited trading so far.

The firm said it had raised £7.8m from the float from institutional investors, in order to fund its first owned surgical hub.

Meanwhile, Wellnex, which floated on the Australian Securities Exchange in 2021, also joined AIM today.

The firm said today it had already raised £5.2m from the IPO, coming in part from institutional backers Premier Miton and Pentwater Capital.

Wellnex, which produces pharmaceutical products, is introducing its products in the UK, with its teeth and oral hygiene brand Mr Bright becoming available in Superdrug and TK Maxx.

The firm’s stock price is down by more than 90 per cent since it floated in Australia.

Earlier this week, two other companies announced they would be pursuing an IPO on AIM, authentication tech firm Quantum Base and accountancy firm MHA.

MHA, the UK arm of Baker Tilly, is aiming to raise up to £125m from the float in the coming weeks, while Quantum Base is looking to raise £3m to £5m.

AIM’s pipeline

Later this month, Creightons is also set to move to AIM from the London Stock Exchange’s main market, after having originally floated in 1987.

“A move to AIM is expected to deliver a significant cost saving, both financially and in management time,” the company said in a stock exchange notice.

The £18.7m beauty products manufacturer cited the less stringent regulation and corporate governance regime on AIM as a key factor in the move.

“The cost and regulatory requirements of the main market have become progressively higher in recent years and are now disproportionately burdensome for a business the size of Creightons,” it added.

Other companies set to move from the main market to AIM in the coming weeks include Oneiro Energy, which is looking to raise £2m from the move.

“We definitely expect 2025 to be a much stronger year for IPOs than 2024, whether that is on the Main Market or AIM, but we shouldn’t be under the illusion that this is the beginning of a significant turnaround in fortunes,” warned Tom Bacon, partner in BCLP’s M&A and corporate finance team.

“There is still a lot the government should be doing to support this market and to incentivise both capital and entrepreneurs back into the market.”