AIM ESG Performance: Social Mobility in Financial Services

Addidat has collaborated with Nurole on its AIM ESG series, providing information about AIM companies’ ESG requirements and performance, along with practical suggestions about what firms can do to improve. This article focuses on key aspects of the social performance of companies operating in the Financial Services sector, in terms of their progress on social mobility.

Social mobility is the aspect of diversity and inclusion which aims to separate a person’s life opportunities from their parents’ socioeconomic background.

Lack of social mobility is a global problem. The OECD, for example, estimates that it takes nearly five generations for children of low income families to earn their country’s average income.

The UK has lower social mobility than any EU countries, and the problem is particularly pronounced in the finance sector.

A report from The Bridge Group identified that 89% of senior roles in financial services are held by people of higher socio-economic backgrounds and that people of lower socio-economic backgrounds (LSEB) progress 25% slower than their peers, with no clear link to performance.

Moreover, studies have shown people from LSEB do not apply for jobs where they perceive people in those roles are upper or middle class. A 2019 study by KPMG, for instance, found that 41% of people working in finance in the UK had relatives in the same sector, far above the national average of 12%.

As with all D&I initiatives, social mobility confers commercial benefits because it creates greater diversity of thought. A report by Oxera suggests increasing UK social mobility to the average level across western Europe could increase annual GDP by £45bn in the long term, equivalent to £670 per person.

What are AIM finance companies currently doing to improve social mobility?

Outreach

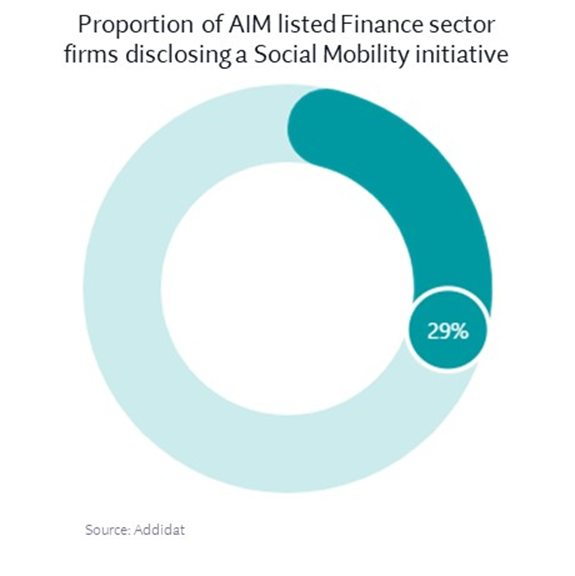

Almost a third of AIM listed finance firms have disclosed they have a social mobility initiative

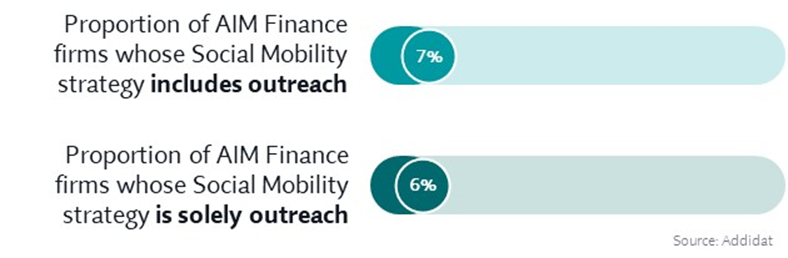

Nearly a third of these firms focus their efforts on outreach. For example, working with charities to provide LSEB mentoring, funding equipment for high LSEB area schools, or donating to Social Mobility charities.

Although outreach may be easier to implement, arguably it is less effective than direct action such as apprenticeships.

Apprenticeships

Currently, 10% of companies are implementing apprenticeship schemes.

Modern apprenticeship schemes are wide ranging: you can become an actuary through an apprenticeship, for example, and Goldman Sachs has started to train apprentices on their trading floor. With the government covering up to 95% of training costs and providing tax breaks, apprenticeship schemes can be a great way to improve a firm’s diversity.

Internships and work experience offer a less formal option than apprenticeships. Historically, these have failed to produce greater social mobility where firms have either not paid their interns, expected too much in terms of entry requirements or have only recruited through personal networks.

Current best practice includes remuneration, lower entry requirements, and an open selection process.

What can AIM finance firms do to better promote social mobility?

- Start with understanding where your business is today.

- Decide on exactly what lower social economic background means to you. Does schooling matter as much as parental professions, for instance. X provides a thorough discussion of this subject.

- Undertake a review of the company and its culture. Do the terms “cultural fit” or “natural fit” exist in its lexicon? What does this imply?

- What informal networks exist that may perpetuate inequality?

- What diverse role models do you have in the business? Are they visible?

- What are you doing already with regards to social mobility? What progress is being made?

- Interrogate available data on recruitment, staff levels and progression.

- Decide on your social mobility strategy and measure your success in achieving it

- Take a decision about whether social mobility will be part of your ESG strategy – do you want to be a leader or aligned with peers?

- Understand what your peers are doing.

- Set meaningful targets and track against them at the board level.

- Hold executives to account, adding criteria to their performance success criteria

- Report to stakeholders on progress and actions.

- Raise awareness within your firm.

- 15th June 2023 is Social Mobility Day. Perhaps use this as an opportunity to organise an event to raise awareness about the benefits and challenges of social mobility, and how and why the board is committed to improve.

- If you don’t yet have employee data to facilitate progress tracking, use the event to build momentum and encourage everyone to disclose the data required (for example, through anonymous staff surveys).

- Review your recruitment, onboarding and people development processes and amend where necessary.

- People development processes are particularly important. Where companies recruit individuals from under-represented socio-economic backgrounds but fail to offer ongoing support, the mid and long term success is limited. More than this, failure to provide this support may decrease social mobility in the longer term.

- Recruitment processes improvements include:

- Reviewing language across job specifications and performance success criteria for biassed language.

- Challenge the skills and qualification requirements – are degrees really required? And are there better ways to select the best applicants? A psychometric test which focuses on cognitive behaviour and personality traits will be a better indication of future value to the company.

- Blind assess CVs by removing potential bias leading data, e.g. geography, school and universities, and especially candidate names.

- Train interviewers on how to identify their own biases and amend processes to account for this, e.g. exclude the professionalism of their dress from the assessment criteria.

- Partner with LSEB focused recruitment and internship firms for improving the level of LSEB candidates.

- Set up an apprentice scheme.

- Reimburse candidates for their travel to interviews.

- Onboarding suggestions include:

- Consider an upfront bonus to facilitate purchasing the expected clothing or any travel ahead of being paid.

- Additional support will likely be required for LSEB starters and their managers, especially those at the beginning of their career.

Further Resources

- Diversity Project: a cross-company initiative championing a diverse, equitable and inclusive UK investment and savings industry.

- Social Mobility Day: offers a good mobility tool kit for its supporters.

- Social Mobility Commission: also offers more general toolkits for finance & professional services – includes resources to help with collecting data, getting buy-in and setting up apprenticeship schemes.

- Progress Together: works solely in the Financial Services industry and focuses on socio-economic diversity at senior levels, defined as Non-Executive Board, Executive Committee and two levels down.

- Sutton Trust: offers a series of programs and research papers designed to promote social mobility.

- Social Mobility Foundation: offers connections with aspiring professionals from LSEBs.

- The Class Ceiling by Sam Friedman and Daniel Laurison: a brilliant, book-length discussion of the causes and effects of low social mobility and what society can do to make things better.

About Nurole

Nurole is the AIM board search specialist and market leader, bringing science to the art of board hiring. We find board members: in 2022, our team of 60 experts placed 700 Chairs, SIDs and NEDs. And we offer them ongoing learning and development opportunities, providing the c.1200 AIM board members in our community with the information and connections they need to become better board operators.

www.nurole.com │ www.linkedin.com/company/nurole

About Addidat

Addidat is the leading provider of ESG benchmark data for the London Stock Exchange AIM market, covering all industry sectors. Our accurate and comprehensive ESG dataset enables our clients to understand what their peers and competitors are achieving in ESG, how they compare and what they need to do to enhance or maintain their positioning.

Addidat’s benchmarking data delivers actionable findings, laying the foundations for successful ESG strategies and providing confidence that investment is being targeted in the areas that matter most to investors, clients, employees and regulators.

www.addidat.com │ linkedin.com/company/addidat-ltd │ hello@addidat.com