African Barrick raises full-year output target

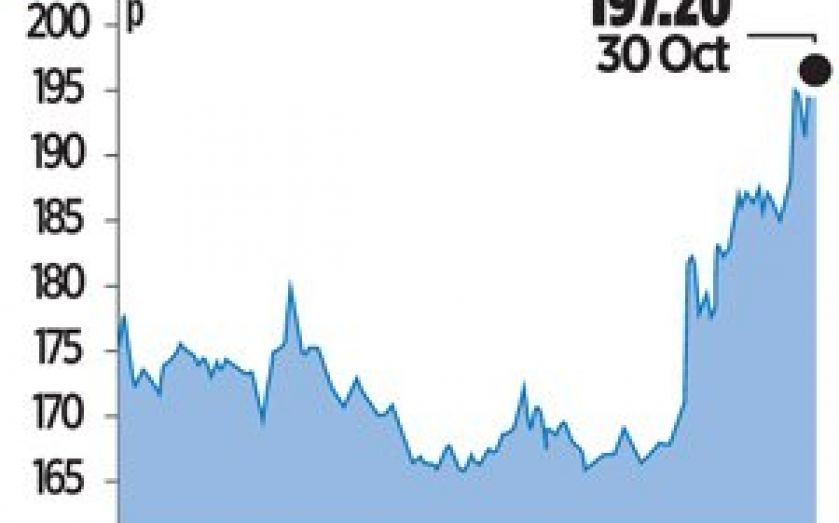

AFRICAN Barrick Gold (ABG) shot to the top of the FTSE 250 leaderboard yesterday, after the miner said it expects to beat full-year production targets and is on track with its cost-cutting strategy.

The firm posted an 11 per cent increase in third-quarter gold output compared to the same quarter in 2012, with cash costs two per cent lower.

It is on track to deliver its target of over $100m (£62.3m) in cost reductions by the end of 2013 and expects full-year production to exceed the upper end of the previous guidance range of 600,000 ounces.

ABG has undergone a management shake-up in recent months and slashed costs in an attempt to turn around its fortunes. The gold producer has struggled with operational issues since its flotation in 2010.

“I am delighted to present a strong set of operational results in my first report as chief executive of ABG,” said Bradley Gordon, who replaced Greg Hawkins as the firm’s boss in August.

“The continued focus on operational delivery and the implementation of cost saving programmes…has resulted in our strongest quarter this year.”

Gordon added that as a result of the increased output, cash cost per ounce would fall below the lower end of guidance at $925 per ounce. Broker Investec said it was “encouraged by the positive production trend” but remains cautious as the firm “is still some way from being comfortably cash generative”.

Shares closed up 15.9 per cent.