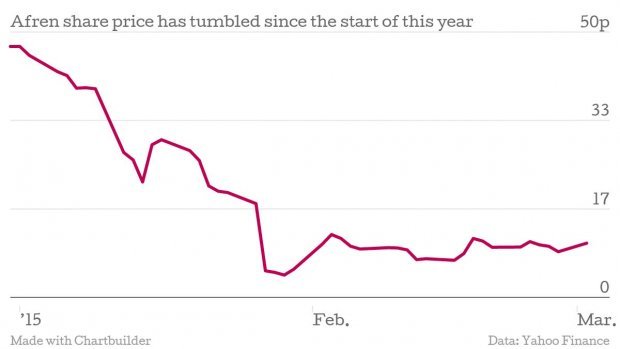

Afren share price jumps as much as 27 per cent after debt deadline extension

Some off the heat is off London-listed oil producer Afren after it secured an extension on its debt repayments.

Afren obtained another deferral of the $50m (£33m) amortisation until 31 March 2015 on its $300m Ebok debt facility. The payment was initially due on 31 January, and the previous extension expired on 27 February.

It will continue using a 30 day grace period under its 2016 bonds with respect to $15m of interest due on 1 February.

The company's shares surged as much as 27 per cent to 11 pence at the open this morning. However, they then fell slightly, and were up 24 per cent at 10.7 pence in early morning trade.

"The company is continuing constructive discussions with the advisers to, and members of, the ad hoc committee of its largest bond holders regarding the immediate liquidity and funding needs of the business," Afren said.

"The company is also having discussions with its other stakeholders and new third party investors regarding recapitalising the company."

Fosun, which recently snapped up Club Med, is reportedly interested in buying up the embattled oil producer. It's backed a $500 million cash deal led by the Afren co-founder Bert Cooper, the Sunday Times said. Nonetheless, it's likely the deal will fail, as Afren's lenders have come up with their own rescue plan.

It comes after Afren ended talks with rival Seplat after it failed to make an offer that's "satisfactory for all stakeholders."

Shares in Afren suffered since January after it revealed a funding crisis, saying it needed $200m (£132m) cash.