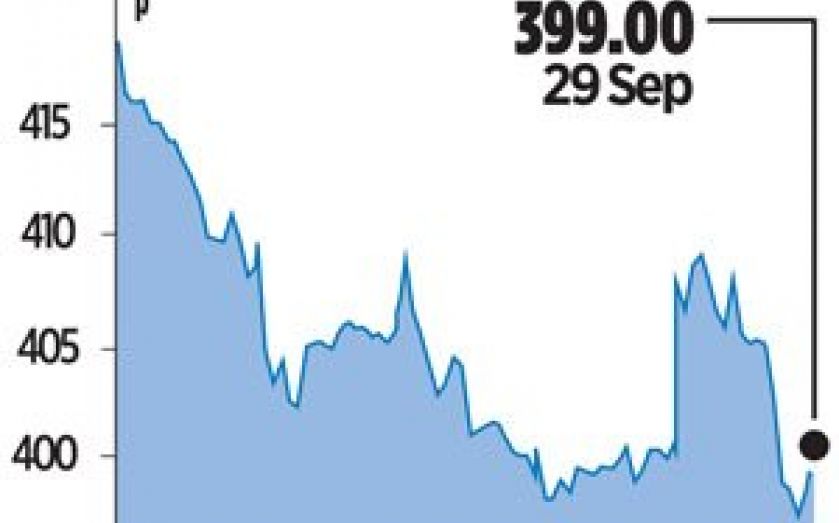

Aberdeen stops the rot as tide of fund outflows slows to a trickle

ABERDEEN Asset Management yesterday said customers pulled less cash from its funds over the summer, signalling the pullback from its key fund classes is slowing.

The group, the largest independent fund house in Europe, saw outflows of £1.7bn for the two months ending 31 August, versus £8.8bn lost in the previous quarter.

“Our equity capabilities are recovering, both in terms of performance and flows following a tough 2013,” chief executive Martin Gilbert said.

Around £1bn was pulled from Aberdeen funds while the other £700,000 was taken out of Scottish Widows Investment Partnership (Swip), the group Aberdeen bought last year.

Most of the outflows came from lower margin products, however, helping prop up shares yesterday.