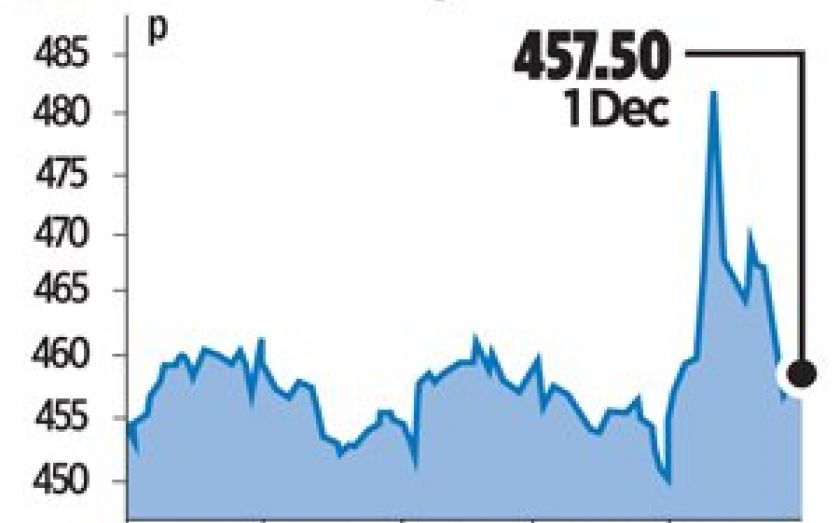

Aberdeen Asset beats forecasts for year’s profit

BRITISH investment manager Aberdeen Asset Management yesterday reported better-than-expected profits for the financial year ended 30 September, despite seeing heavy outflows from emerging markets.

The Scottish asset manager recorded a two per cent increase in underlying pre-tax profit to £490.3m. The figure was generally above analysts’ expectations, with Canaccord Genuity forecasting £480m.

Net revenue was up four per cent to £1.12bn, and assets under management rose 62 per cent to £324.4bn following the firm’s £660m purchase of Scottish Widows Investment Partnership (Swip) from Lloyds earlier this year.

However, the investment firm also saw its earnings-per-share drop four per cent and net outflows of £20.4bn on the back of the poor performance of emerging markets. Chief executive Martin Gilbert told City A.M.: “We are very pleased with earnings-per-share only being down four per cent in what has been a really difficult year for emerging markets. The Swip acquisition has bedded in nicely and we’ve taken out most of the cost. There’s a big cash balance at over £600m, so all-in-all the company’s in quite good condition.

“Going forward, we think equities is a good place to be – we’re seeing good flows into our property fund and emerging market bonds look good value.”