Abbey makes moves on mortgages

Abbey is to mount an assault on the British mortgage market by plugging into new business areas.

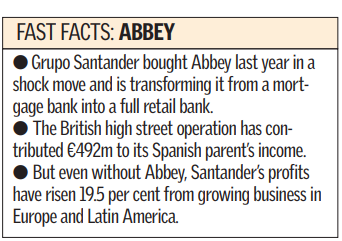

The bank, which was taken over by Spanish group Santander for £8bn last year, wants to make up ground lost to its rivals in the areas of lending to buy-to-let investors, people wanting loans for new-build properties, and the “sub prime” market, it said yesterday in a third quarter trading update.

The sub prime market is predominantly mortgage lending at higher interest rates to customers who have been turned down in the past.

Those three, fast-growing groups of customers — together about 20 per cent of the British mortgage market — are areas Abbey has been slow to exploit.

Analysts questioned whether the move was wise given Britain’s burgeoning consumer debt problem. However, the bank claimed any risk would be minimal as it would market the products to its existing 18m customer base, 11m of whom only have one Abbey product.

Abbey also said yesterday that more job cuts are on the way in addition to the 4,000 already announced. Trade unions fear 2,500 more jobs could go in a £300m cost-saving exercise currently being implemented by the Spanish owner. It is expecting to have made £200m of cost cuts by the end of the financial year, leaving it with another £100m to make by the end of 2007.

Francisco Gomez-Roldan, chief executive, said: “We want Abbey to be the best retail bank on the high street.”

Santander also flexed its considerable financial muscles yesterday by announcing a $2.4bn deal to take a 19.8 per cent stake in Sovereign Bancorp, the American bank.

The announcement from the world’s ninth-biggest bank coincided with figures saying its earnings for the first nine months of the year exceeded the €3.6bn it made in the whole of 2004.