AA shares motor ahead despite dent in profits

MOTORING group AA yesterday revealed a large dent in its profits from finance costs related to its stock market listing in June.

While revenue rose in the half year to the end of July, profits before tax fell to £10.2m, well down from the £121.2m a year earlier.

The company said exceptional costs were £39.4m, up from £10.2m in 2013, and financing costs increased to £138.6m from £47.1m.

Executive chairman Bob Mackenzie said the company’s maiden first-half results reflected only a few weeks of operations under new ownership and forecast full-year profit in line with market expectations.

“In terms of the future, our task is to better capitalise on the strength of the AA brand; make the right investments to enhance our service to members and customers, and reduce the leverage of the business,” said Mackenzie.

He said the AA had a long-term growth plan based on updating its IT systems. The company also wants to use existing data to improve its insurance arm, which has seen a reduction in customers in recent years.

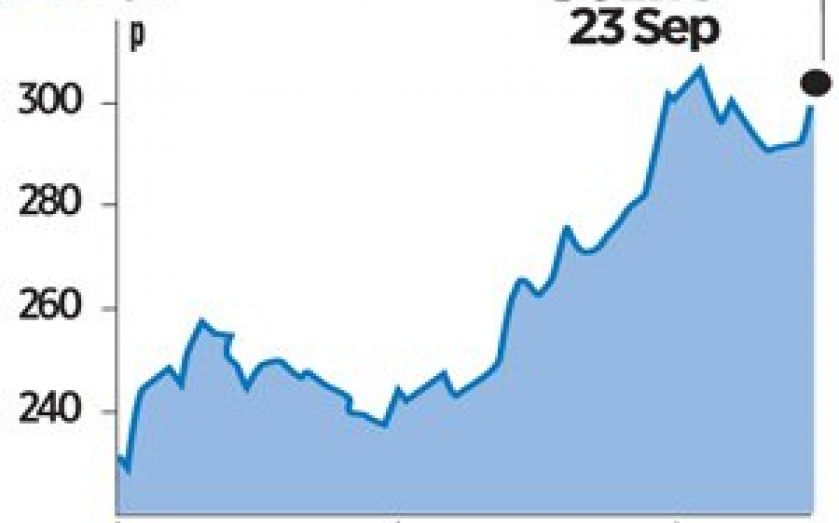

Investors appeared to agree with the management strategy, with shares rising 4.02 per cent to 303.75p.

Broker Cenkos gave the company, best known for its roadside recovery service, a “buy” rating, saying: “Given that these results were mainly from the ‘Old AA’ – the new management had only had the keys for about a month – it’s the outlook that matters. Reassuringly, management is intent on refining and strengthening the AA formula – of solid revenue bases built on the highest quality customer proposition.”