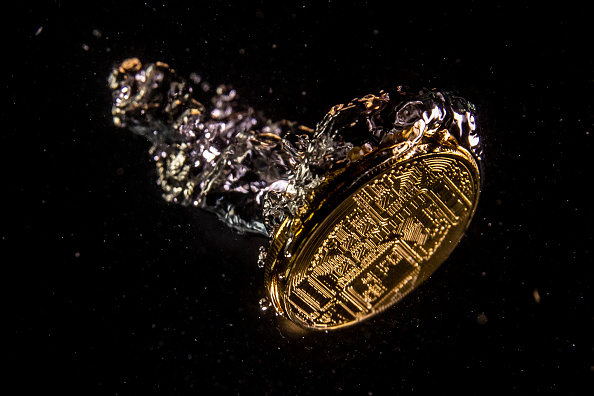

A textbook crypto capitulation, or is Bitcoin getting dragged down by market contagion?

The week in review…

with Jason Deane

It doesn’t matter what major developments or fantastic new breakthroughs towards Bitcoin adoption are happening in the world, all everyone is talking about today is “what happened to the markets?”.

Well, it’s a fair question.

As soon as the red candles started piling up, I was contacted by a number of journalists looking for comments, and, frankly, apart from a few theories that I was quickly exploring, I really didn’t have answers at that point, other than saying it looked like a “textbook capitulation event“.

Some will disagree with that statement, arguing volumes and depth were not sufficient to call it that, but clearly something was going on here. One observation, made by Jason Goepfert at Sundial Capital Research, noted that both the S&P 500 futures were down three per cent and the 10 year futures were down one per cent – a combination so rare that it has only happened on two days before now.

Those dates, incidentally, were October 9 2008 – the day the effects of the ‘Credit Crunch’ became apparent, and March 18 2020 – the day of the initial Covid-19 sell off. Could it simply be a case of market contagion pulling down tech and Bitcoin at the same time?

The thing with markets is that you quite often don’t know why things happen the way they do until later on. Sometimes you never really know for sure. All we do know is that it looks pretty grim out there for now, but, frankly, so does the rest of the macro landscape.

Russia continues to be hell bent on ostracising itself from everyone else on the planet while trying to do as much damage as possible to everyone else economically and militarily for reasons that are probably only clear to Putin. The whole thing will almost certainly go down in history as a fantastic error of judgement and the Ukrainians are being forced to pay the highest possible price for that mistake.

But in the end, it will ultimately cost all of us dearly as well. According to this simulation carried out by the National Institute of Economic and Social Research, the global economy is set to lose over a trillion dollars of GDP in the next year or so as a result of the war, while adding severe inflationary pressure at the same time. If that’s not depressing enough, this report was from March 7 and all the scenario parameters have already been exceeded. In other words, it’s going to get very, very messy.

Inflation is now eroding our money’s value at the fastest collective rate since our current monetary system began in 1971 and central banks, like the Bank of England and the Fed, are raising rates to try and contain it, just as they did this week. It won’t be enough.

So what’s the bottom line? Being financially aware is now probably more important than it has ever been before. Yes, we’re all affected by macro events that don’t look good, but ultimately our financial future is always in our own hands, even if we don’t always remember that.

And with that slightly more uplifting thought, I hope you have a fabulous weekend!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits into it? Come to my next free webinar on Tuesday May 24 at 6pm to find out, ask any questions, and grab some free Bitcoin*. Click here to register.

*18+, UK resident, new to Luno only

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1.666 trillion.

What Bitcoin did yesterday

We closed yesterday, May 5 2022, at a price of $36,575.14. The daily high yesterday was $39,789.28 and the daily low was $35,856.52.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $691.66 billion. To put it into context, the market cap of gold is $11.907 trillion and Tesla is $904.72 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $46.408 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 33.52%.

Fear and Greed Index

Market sentiment today is 22, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 41.79. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 41.52. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Bitcoin mining is the cleanest, most efficient, most valuable use of energy in the entire state of New York, and yet politicians want to limit its growth & drive the industry elsewhere.”

Michael Saylor Founder & CEO of Microstrategy

What they said yesterday

It aint over till its over…

Daily PSA…

Can you spot the pattern?

Crypto AM: Editor’s picks

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

Meet the hackers helping people recover lost crypto assets

The cryptocurrency fundraisers behind Ukraine’s military effort

Exclusive: Fireblocks valuation climbs to $8bn in $550m funding round

Crypto crazy couple name baby after favourite digital asset

Bitcoin hashrate touches new all time high

Peter McCormack: Transforming Bedford FC into a global Bitcoin brand

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST