Polymetal plummets after it agrees to buy challenging gold mine

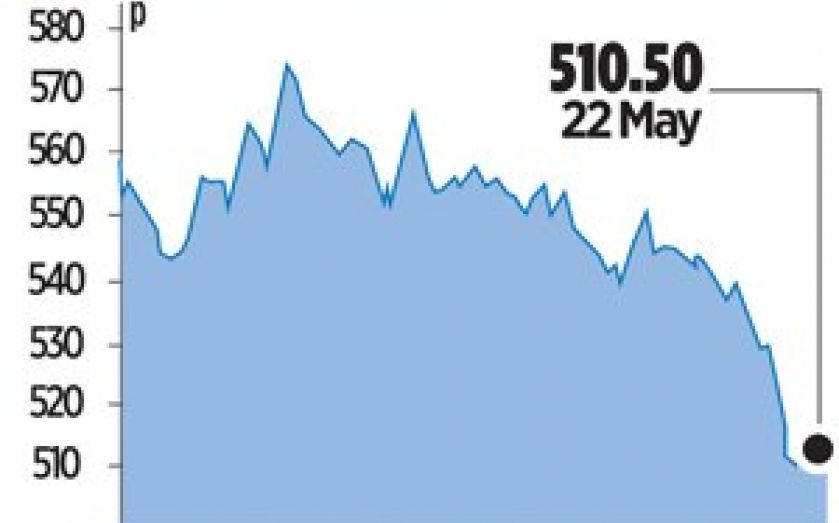

RUSSIAN precious metals miner Polymetal’s share price plunged six per cent yesterday, after it said it had agreed to buy a gold project in Kazakhstan for $618.5m (£366.8m).

The FTSE 250-listed firm is buying the assets from private owners Sumeru Gold and Sumeru LLP, for $318.5m in cash and £300m of new Polymetal shares, marking the return of large deals in the sector since the gold price fell last year.

“The acquisition price looks reasonable but the project is renowned to be tricky,” warned analysts at Numis, referring to challenges from the geographic make-up of the deposit.

Polymetal is undertaking a revised feasibility study with an updated reserve estimate in the fourth quarter of 2015. It plans to start construction at the start of 2016 and begin production in 2018, dependant on the feasibility study.

“The Kyzyl Project fully meets our definition of a suitable acquisition opportunity: a large, high-grade asset with a clear path to production and cash flow generation leveraging Polymetal’s core strengths in selective mining and refractory ore processing,” said chief executive Vitaly Nesis.