Man Group in talks to buy US fund boutique

THE WORLD’S biggest listed hedge fund Man Group yesterday confirmed it was in talks to buy US-based group Numeric Investors, the first time in over two years the highly acquisitive group has hit the dealmaking trail.

Man, which bought hedge fund GLG in 2010 and fund advisory FRM in 2012, has been talking to the Boston-based fund manager in recent weeks about acquiring the quantitative-based group to sit alongside its flagship quant unit AHL.

Boss Manny Roman has made no secret of his desire to pursue bolt-on acquisitions in a bid to diversify the group’s revenue streams, but said he would be “disciplined” on price.

Crude estimates suggest the group may have to pay $360m (£215m) to acquire Numeric, which operates so-called long only strategies analysts say are complementary to AHL.

Numeric, which is controlled by private equity group TA Associates, recently grew the money it manages to $13.9bn from $7.7bn, which will also fuel its appeal.

Man could also be tempted to buy Numeric to give it a US presence, where distribution of its products has been lacking compared to Europe.

The FTSE 250-listed group has more cash to spend since it secured approval from the Financial Conduct Authority to change its regulatory status last April, freeing up $550m of capital.

“Numeric’s investment performance and product set make it a good fit for Man Group, in our view,” HSBC analyst Nitin Arora said.

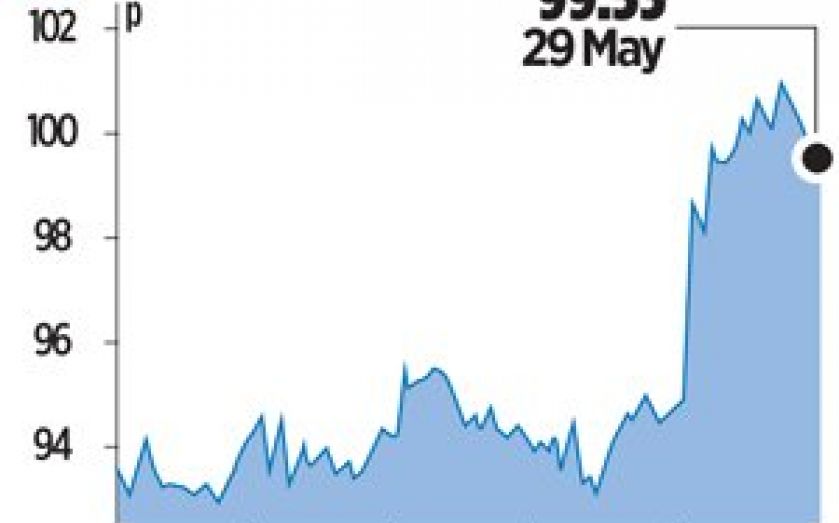

Markets also cheered the talks, sending shares up five per cent.