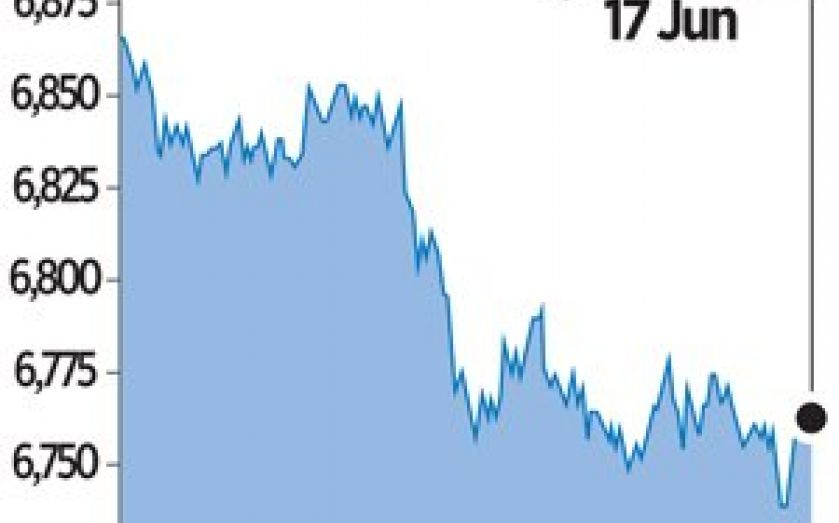

FTSE 100: Shire and Morrison help index end on a high note

Bid speculation surrounding pharma giant Shire, proposed cost savings at supermarket operator Wm Morrison and a strong update from Premier Inn-owner Whitbread yesterday helped lift the FTSE 100 index slightly.

The bluechip index closed up 12.13 points, or 0.2 per cent, at 6,766.77.

Shire jumped 3.5 per cent to 3,660p, providing the biggest boost for the FTSE 100, as healthcare companies saw a wave of merger and acquisition speculation in the past two months. The second-best riser was Morrisons, up 2.3 per cent to 192.6p, after it proposed changes to its store management that would lead to around 2,600 redundancies.

Morrisons, which issued a profit warning in March, has lost 26 per cent of its value this year.

And Whitbread reported a robust start to the year, driven by strong growth at its Premier Inn hotels. Its shares rose 2.2 per cent to 4,259, making it the third top riser.

Ashtead was the biggest faller, down 6.3 per cent despite posting strong results.