London Report: Turbulence for easyJet as FTSE loses altitude

EASYJET proved to be a drag on the FTSE 100 yesterday as the low-cost airline felt the effect of a broker downgrade.

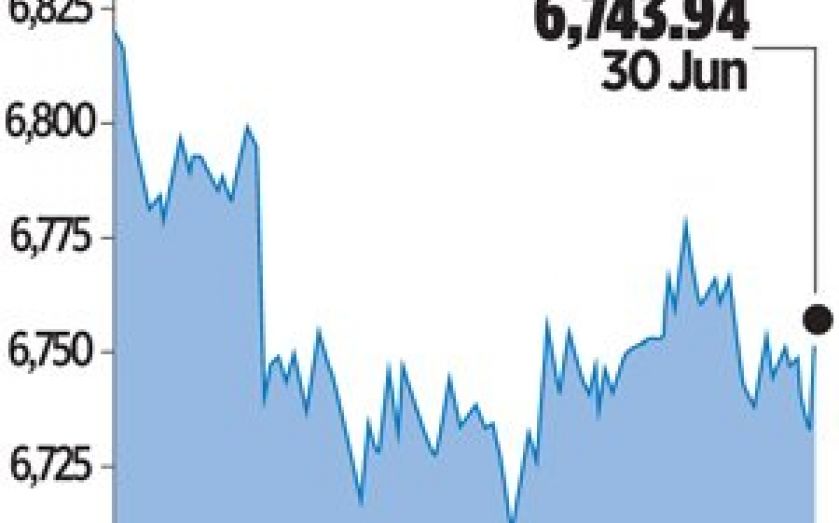

The blue-chip FTSE 100 index ended down by 0.2 per cent, or 13.83 points, at 6,743.94 points – down more than two per cent from its 2014 peak of 6,894.88 in May, which marked its highest level since December 1999.

EasyJet fell 6.4 per cent, making it the worst-performing FTSE 100 stock in percentage terms, after Bank of America Merrill Lynch cut its rating on the stock to “underperform” from “neutral”.

Bank of America Merrill Lynch said earnings headwinds were expected to put pressure on easyJet’s shares, and the airline also dragged down rival British Airways-owner International Airlines Group, which fell 3.5 per cent to close on 370.50p.

The fall knocked more than £130m off the value of the stake held by Sir Stelios Haji-Ioannou. But there was better news for the entrepreneur from the Aim market. In its first day of dealings on the junior market his budget hotel group easyHotel ended at 87.5p, up from its 80p a share flotation price.

The biggest climber on the day was biotech firm Tiziana Life Sciences, whose shares jumped 17 per cent to 49.13p after it signed a licence agreement with TTFactor, acting on behalf of the Italian Foundation for Cancer Research, the Institute for Molecular Oncology and the European Institute of Oncology.

Gold and silver mining company Fresnillo closed up two per cent at 872p, as it benefited from the price of gold staying near a two-month high.

Drinks group Diageo also bucked the weaker market to rise per cent per cent to 1,866p on speculation of a possible tie-up with SAB Miller.

Among the fallers, Sports Direct International lost 17p to 706.5p ahead of its latest attempt to win over shareholders to its incentive scheme for employees, including its chief Mike Ashley. The company squashed trade talk it was considering an offer for footwear retailer Office, but talk of a possible tie-up refuses to go away.

Most traders and investors expect the FTSE 100 to reach a record-high 7,000 points in 2014, on expectations of a further strengthening in the British economy, better corporate results and more corporate takeover activity.

However, the FTSE has failed to break through the 6,900 barrier so far, and has underperformed rivals such as Germany’s DAX and the US S&P 500, which have both climbed to record highs.