FirstGroup share price hit by critical letter from investor Tom Sandell

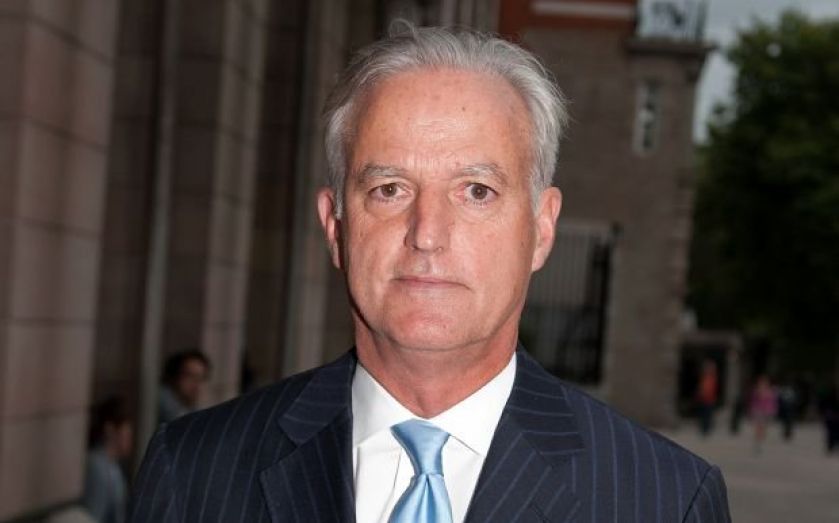

FirstGroup shares fell 2.69 per cent to 126.60p yesterday, following high profile criticism of management pay at the rail and bus company by activist investor Tom Sandell.

The comments in an open letter said that management had “significantly underperformed” and had increased remuneration was not “deserved”.

However, yesterday sources close to the company raised doubts over the strength of support for Sandell’s case, saying that not a single other shareholder had yet publicly backed the criticism.

Sandell has forcefully argued since last December that FirstGroup should sell off its US assets and focus on its UK operations, suggestions that FirstGroup has ignored in favour of its own recovery strategy supervised by chairman John McFarlane.

FirstGroup sought to defend its embattled chief executive’s pay package ahead of the annual meeting on 16 July, when shareholders will vote on the remuneration proposal.

A FirstGroup spokesman said: “Our executive directors saw their basic pay frozen in 2013/14, as it has been for the past two years, and received just over half of their potential bonus. This is the first annual bonus that Tim O’Toole has taken since he became CEO and reflects the progress the Group has made.”

Last year, 30 per cent of shareholders voted against FirstGroup’s pay report.