London Report: FTSE 100 lifted by Sports Direct and Shire talks

BRITAIN’S top equity index rose for a second straight day in thin trade yesterday, helped by rises in bid-target drugs firm Shire and retailer Sports Direct.

Shares in Shire hit a record high of 5,045 pence – before paring back gains into the close – after its board said it was ready to recommend a new offer from AbbVie.

The new bid – the fifth by AbbVie – values Shire at £31.3bn. Some traders saw the announcement as opening the door to further bids, with AbbVie’s 5,320p-per-share offer as a starting point.

“The board could have been minded to accept AbbVie’s offer as a floor, and as it has now established that it is willing to sell the company (unlike AstraZeneca ), (it) is effectively putting a for-sale sign in the window,” a London-based event-driven trader said.

AbbVie, which wants to buy Shire to cut its tax bill and diversify its product line-up, raised its bid after the Dublin-based company asked for an improvement on its previous 5,115 pence-per-share offer.

Other traders were more cautious on Shire’s stock, which has surged more than 40 per cent in the past month. Galvan’s head of trading, Ed Woolfitt, sold half of each of his clients’ exposure to Shire.

“So we’re banking something good on the bounce and leaving the other half on just in case (it climbs to 53),” Woolfitt said.

Shire’s shares closed up 0.7 per cent at 4,903p on volume that was four times higher than its full-day average for the past three months. FTSE 100 volume was 35 per cent lower than the index’s own average.

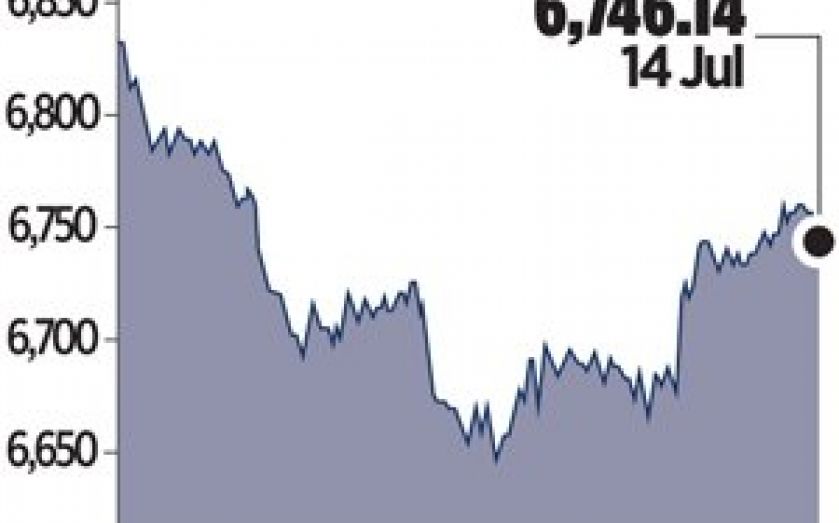

The FTSE 100 ended up 55.97 points, or 0.8 per cent, at 6,746.14 points after trading as high as 6,760.73 points. The index dropped 2.6 per cent last week to post its biggest weekly drop since March as sentiment was hit by the threat of a banking crisis in Portugal.

The FTSE trimmed its gains into the close, a pattern already shown on Friday and which normally denotes faltering investor confidence.

Helping keeping the FTSE buoyant was sports retailer Sports Direct, up 3.6 per cent after revealing plans to open in Australia and New Zealand by forming a partnership with MySale Group. Rolls-Royce also rose, tacking on 1.3 per cent as European planemaker Airbus kicked off the Farnborough Airshow by confirming it would sell revamped versions of its A330 wide-body jet powered by Rolls-Royce Trent 7000 engines.