Amazon share price dives as losses increase

More of the same from Amazon, as it continues its tradition of favouring growth over profits.

The e-commerce giant has just announced a loss of $126m, or $0.27 per share for the three months to the end of June, coming in significantly below Wall Street estimates of a $0.15 per share loss.

The second quarter has seen a significant widening of the company's losses compared to the same period last year, during which the company posted a loss of $7m, or $0.02 per share.

This is despite Amazon's revenue recording a 23 per cent jump, climbing to $19.3bn from $15.7bn in the same period last year.

The revenue is exactly in line with what analysts were anticipating and constitutes an increase of 23 per cent year-on-year.

But are investors starting to get impatient?

The retailer's share price, which is often highly volatile in reaction to earnings reports given how little information the company releases about its strategic plans, has taken a dive on the latest results, tumbling almost 10 per cent in after hours trading.

As an indication of how explosive Amazon's stock is in the follow up to earnings, it averages a 9.5 per cent move either way, according to figures from Bespoke.

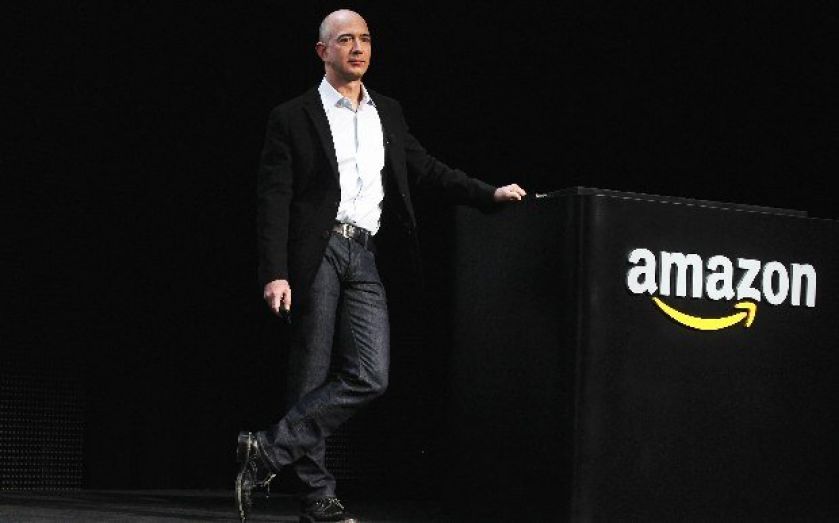

These latest results come amid a lively period for the Seattle-based company as owner Jeff Bezos continues to prioritise growth in a host of different areas as it looks to dominate, well, seemigly everything.

To say that Amazon has had a busy 2014 would be quite the understatement. So far this year, the huge online retailer has announced a file sharing device aimed at corporate clients, an ebook subscription service with over 600,000 ebooks and audiobooks available at a fixed price of $9.99, a streaming device for video and games, a music streaming service for its US Prime users and of course its foray into the crowded and highly competitive smartphone market with the launch of the Amazon Fire.

Investors have traditionally been willing to forgive narrow profits or even losses based on the view that Amazon is simply ploughing its continuously increasing revenue back into development, with top line growth the focus for now.

But with the firm indicating it may report more losses in the next quarter and given the struggles that the stock has had in 2014, already down 10 per cent this year before today's losses, are investors beginning to feel increasingly worried with the numbers coming out of Seattle?

In line with past quarterly reports, the company did not break down specific numbers for particular aspects of its business, including the lucrative Amazon Web Services (AWS), its cloud computing service. But analysis of Amazon’s “other” revenue for North America, which includes AWS, has shown that the growth of the cloud business slowed.

The growth rate dipped from an increase of 60 per cent in the first quarter on the same period last year, to 38 per cent in the three months to June compared to 2013's second quarter. This is likely down to a price war with other providers entering the cloud computing market and bringing about increased competition in the sector.

As the company prepares to launch its Fire smartphone in the US on Friday, potentially the heavy investment in several new business lines announced over the last few months will again buy Bezos and Amazon some breathing room.

But the steep slide in the share price perhaps implies that patience among shareholders may be running a little thin at the moment.

The value for July 25, 2014 on the chart shows how the stock has performed until 10.50am New York time (3.50pm London).