London Report: Fall in financials brings London’s market down

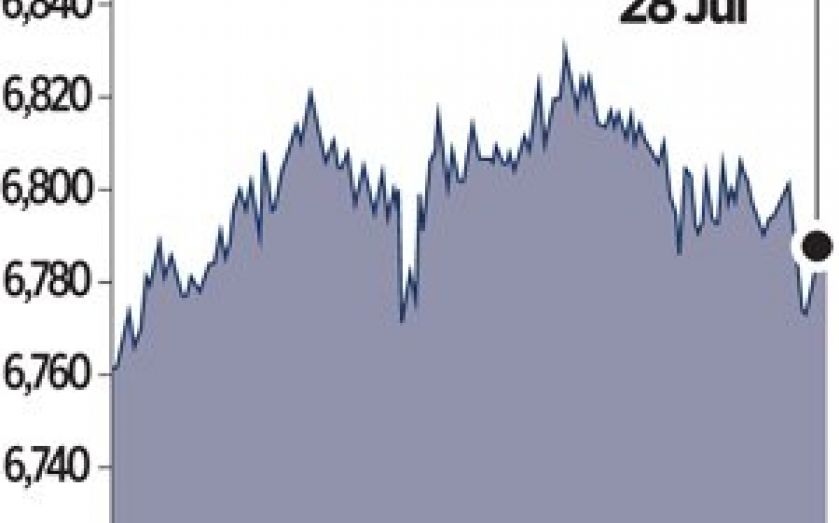

THE FTSE 100 yesterday ended down after weak US housing data discouraged investors in America and Europe during a data-light European day.

The blue chip index lost 0.1 per cent to close at 6,788.07. Earlier in the day it had traded as high as 6,809.61, but moved lower together with other markets after pending home sales in the US fell in June for the first time in four months.

Shares in Aberdeen Asset Management led the fallers and slumped 5.3 per cent to 435p after the company reported a decline in third-quarter assets under management.

Pharmacy giant Glaxosmithkline slipped 0.6 per cent to 1,414.50, after the chief executive told the Financial Times that the company was open to spinning off its consumer health-care business.

On a more upbeat note, Reckitt Benckiser Group gained 2.7 per cent to 5,205p, after the company said it would pursue a spinoff of its pharmaceutical unit to focus more on its core consumer health and hygiene business. Additionally, Reckitt Benckiser reported a seven per cent fall in second-quarter sales.

Shares in easyJet climbed 0.9 per cent to 1,344p after Citigroup upgraded the budget airline to buy from neutral.

Ryanair Holdings gained 2.63 per cent to €7.03p after Europe’s largest low-cost airline increased its profit forecast for the current financial year.

British Sky Broadcasting clawed back some of the losses it made on Friday as it announced a deal to buy Italian and German pay-TV operators from 21st Century Fox. The broadcaster rose 3.43 per cent to 904.50p.

Lloyds Banking Group was also in the spotlight after US and UK authorities imposed roughly $370m (£218m) of fines on the bank for attempting to rig the London interbank offered rate, or Libor, and other widely used interest-rate benchmarks.

Lloyds shares closed marginally higher (0.04 per cent), at 74.84p.

The fact that Lloyds would be fined had been widely flagged, but the ongoing regulatory pressure on Lloyds and other banks still dragged down the shares of its part-nationalised rival, the Royal Bank of Scotland (RBS.L).

RBS, which had surged 10.8 per cent on Friday after posting surprise second-quarter profits, closed down 3.4 per cent at 352p.