London house prices up 25.8 per cent in a year: How do other UK regions compare?

Yet another report, this time from Nationwide, has shown that London house prices have soared in the last twelve months.

Growth is slowing, however, and the latest figures show that the average house price in the UK rose by just 0.1 per cent, below expectations of a 0.5 per cent increase and lower than the one per cent increase we saw in June.

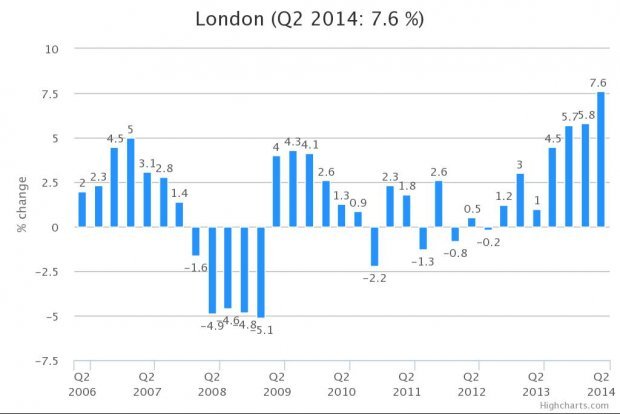

According to Nationwide, London house prices went up by 25.8 per cent in the last year and by 7.6 per cent in the last quarter, in both cases the highest of any region.

But this comes with a caveat, since the Land Registry, which calculates prices on average price paid, found that the average cost of a house in London increased by only 0.1 per cent in June and prices in the capital are no longer the fastest growing in the UK.

We are probably seeing a calming of the market, but, as many analysts claim, the longer term trends usually give a better picture. Here is how the regions have performed in the past year:

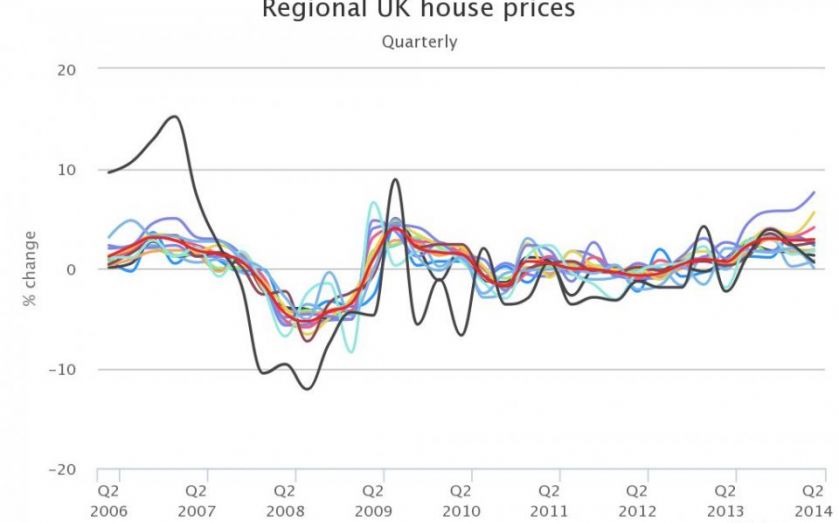

This shows us much of what we already know: house prices are growing very differently in different parts of the country. Now if we want to look at the long term trends for each region we need to separate them out, because if not the graph you come up with is somewhat inscrutable.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What we can gather from the collection of small multiples is that the recovery is far stronger in some regions than in others. All regions appeared to have healthy price growth in 2006, which began to fall sharply into 2008 and 2009 and then recovered slightly before slipping into a sort of limbo until mid 2012.

The UK in general has just about recovered from the slump and is ticking along with growth of around three per cent: similar to 2006. Other regions, like Yorkshire and Humberside, have seen a spurt of growth before slower upward movement is resumed.

Only London, the outer met and the south east are steaming ahead of 2006 levels. We can expect this uneven recovery to continue, and we can expect London to remain as the engine for property price growth. The slowing down is likely to be temporary, even if growth isn't quite so explosive over the next few months.

As Paul Smith, CEO of Haart, the UK’s largest independent estate agent, said:

House prices are not falling off a cliff, these latest figures show they are currently having a welcomed ‘pit-stop’ – which is necessary for long-term, sustained growth. Annual growth figures are always a far more reliable indicator of long term trends.

The below map shows which regions Land Registry data demonstrate to be growing most rapidly.

To scroll down on mobile, please swipe to the right of the map: