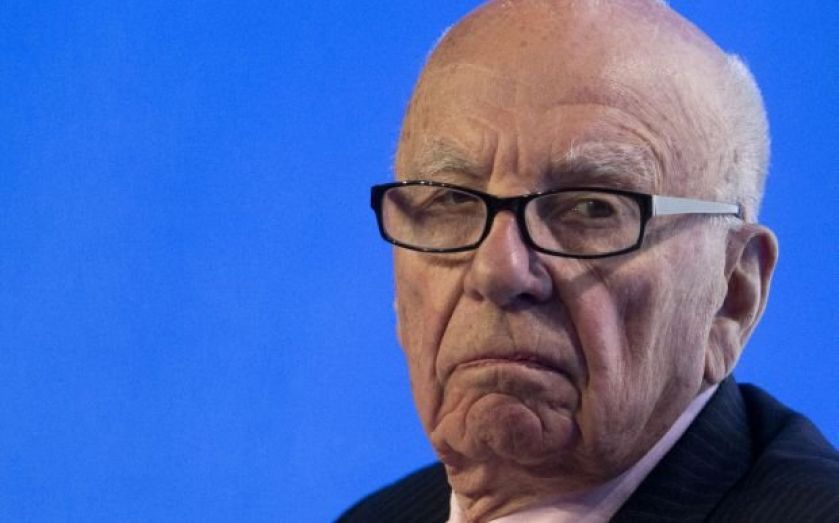

Rupert Murdoch doesn’t retreat, he just regroups – Bottom Line

And just as quickly as he arrived, Murdoch’s gone. His more-than-$80bn (£47bn) bid for Time Warner was swiped from the table almost as suddenly as it landed, and some Time shareholders will be disappointed to see it go.

Underestimating Rupert Murdoch is never wise, and though his withdrawn bid may look like a retreat, he’s more likely to be regrouping. The media mogul certainly expected his offer to be taken more seriously, but once he realised Time Warner’s “management and its board refused to engage” there was little to be done.

Time Warner’s chief executive Jeff Bewkes last month snubbed Murdoch’s offer and told the company’s shareholders that his own plans for Time Warner were better than the “significant strategic merit and compelling financial rationale” that Murdoch teased at in his offer.

But the timing of Murdoch’s withdrawal, less than 24 hours before both companies report earnings, along with Fox unveiling a new $6bn share buyback for its shareholders, has put Time Warner (and its stock) firmly in the backseat.

Now Time Warner’s shareholders, quite rightly, will expect Bewkes to deliver on his promises, and quickly.

But if yesterday’s share price slump is any indication, Time Warner’s management has a long way to go before it proves that its plan is the right one.

And if Bewkes fails to deliver… then Murdoch may find himself in the driver’s seat once again.