Gemfields hails a momentous quarter as ruby auctions begin

Precious stones miner Gemfields, which owns luxury brand Faberge, yesterday described its past quarter as “momentus” with the first auction of rubies from its Montepuez mine.

“The auction represented a profound shift in the ruby industry and underscored the prospects of our model and vision for the coloured gemstone sector. We are excited by the potential for our ruby auctions to follow the progress we have seen in our emerald auctions,” said chief executive Ian Harebottle.

Investors were less enthusiastic, lifting Gemfields’ shares just 0.25 per cent to 49.25p yesterday after the company reported a 29 per cent fall in emerald and beryl production to 6.3m carats.

“Gemfields’ production report, although weaker year-on-year, gave no major cause for concern since the nature of the asset base typically delivers considerable volatility. We look towards updates on future ruby auctions that will better define the possible value to be unlocked from Montepuez,” said Investec analyst Marc Elliott.

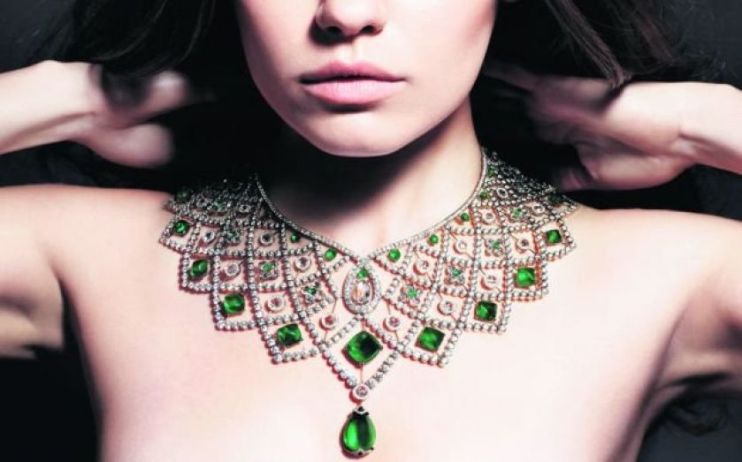

Hollywood actress Mila Kunis joined Gemfields as its brand ambassador last year