Public purse under strain from house supply crisis

THE UK’S chronic lack of housing supply is forcing hundreds of employed people to claim housing benefit every day, as prices continue to climb.

As demand for property continues to surge, the National Housing Federation (NHF) today reveals the how Britain’s housing shortfall is straining the public finances. According to shocking new research, 310 workers turn to housing benefits on a daily basis, putting a £12.1bn burden on taxpayers since 2009.

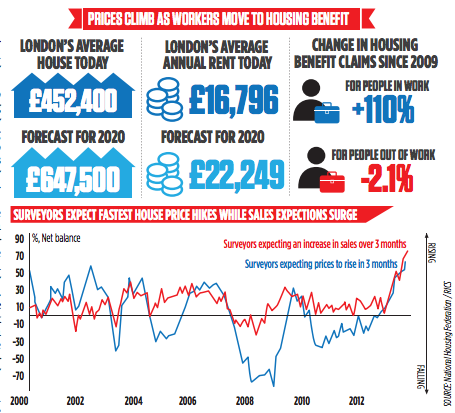

Without a huge increase in house building, house prices and rents in London will continue to swell at eye-watering rates, analysts predict. The price of an average home in the capital is expected to surge upward by nearly £200,000 by 2020, rising to £647,500. Rents will grow by a third in the same period. The number of people in work and claiming housing benefits in London has more than doubled since 2009, while the number not in employment who are claiming has actually dropped by 2.1 per cent.

The Royal Institution of Chartered Surveyors (RICS) also reveals the strongest expectations for house price growth in 14 years today: 59 per cent more surveyors predict that prices will continue to rise than expect a drop, the highest level since 1999.

“House building is on the up, but it is rising nowhere near quickly enough to make up the shortfall that has built up in recent years,” said RICS’ chief economist Simon Rubinsohn. “If there is not meaningful increase in new homes, the likelihood is that prices, and for that matter rents, will continue to push upwards making the cost of shelter ever more unaffordable.”