Glaxo betting on India with $1bn pharma buyout

GLAXOSMITHKLINE has decided to spend roughly $1bn (£613m) to raise its stake in its Indian pharmaceutical unit, betting on rising demand in emerging markets as sales in developed economies slow due to a wave of patent expirations.

With the latest India deal announced yesterday, GSK is set to spend close to $2bn in roughly a year to increase its holdings in two listed Indian companies, its biggest incremental investment in any country in that period.

GSK said it plans to raise its stake in its Indian pharmaceutical unit, GlaxoSmithKline Pharmaceutical, up to as much as 75 per cent from 50.7 per cent through an open offer.

“This really reflects the opportunity we see here in India, particularly the volume opportunity,” said David Redfern, chief strategy officer of GSK, referring to the company decision to raise stake in the Indian unit.

“We have a broad range of medicines and vaccines and we really think over the next few years as India develops we can drive a substantial increase in volume to make more medicines and vaccines available to the Indian population.”

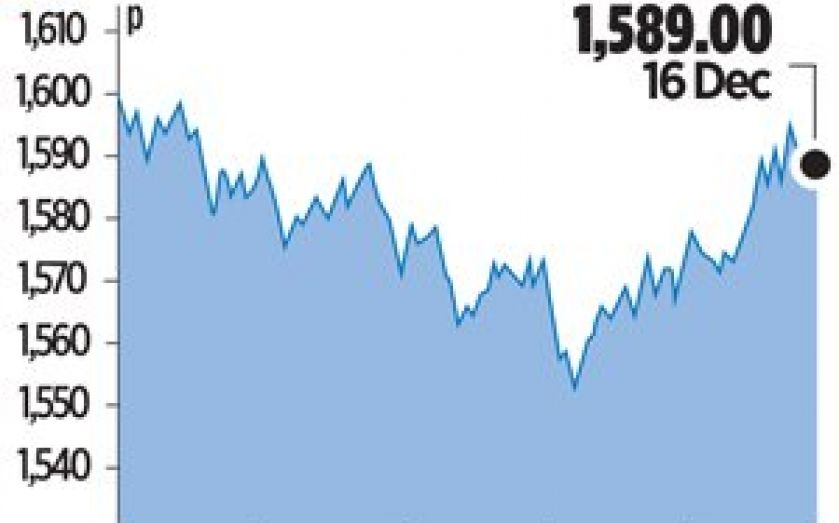

GSK will buy up to 20.6m shares of GlaxoSmithKline Pharmaceutical at 3,100 rupees a share, a premium of 26 per cent over its closing market price on Friday. In London GSK shares closed up 1.2 per cent at 1,589p.