Overseas investment in London property to hit pre-crisis levels

OVERSEAS investment in London’s property market could top pre-recession levels by the end of this year, boosted by an influx of spending from Asian buyers.

According to figures released today by law firm Mayer Brown, Asian investors doubled their investment in the central London market to £5.8bn last year, up from £2.91bn the previous year.

Almost 70 per cent (£4.02bn) of this was focussed on properties in the City, including the purchase of the Lloyd’s Building by Chinese insurer Ping An for £260m.

Total overseas investment in commercial property in London totalled £19.9bn last year compared with £20.54bn at the height of the property market in 2007.

“London is at the economic centre of Europe so foreign investors continue to be drawn to the capital by a weak pound and the UK’s status as a haven for capital,” Mayer Brown’s European head of real estate Martin Wright said.

“Overseas investment from Asia will certainly grow in 2014 and we could by the end of this year see turnover exceeding pre-global financial crisis levels,” he added.

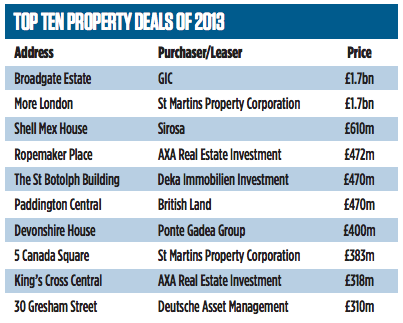

Singapore’s sovereign wealth fund GIC took the crown for the biggest deal of 2013 and one of the biggest European deals since the financial crisis, after acquiring Blackstone’s half stake in Broadgate in December for £1.7bn.

Asian buyers were not the only players snapping up property, with seven of the top ten property deals made by other regions including the Middle East, the US and Germany.