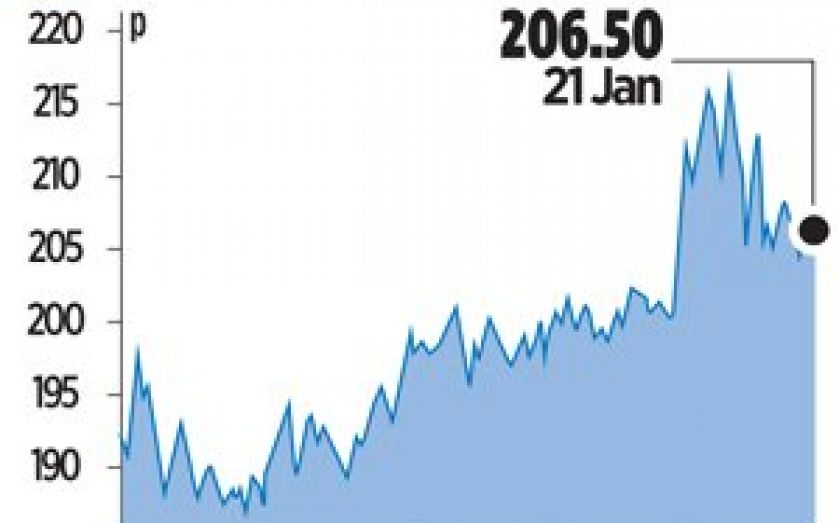

African Barrick soars on strong output figures

AFRICAN Barrick Gold’s chief executive yesterday vowed to continue to drive change and cut costs, as the Tanzania-focused miner unveiled strong fourth-quarter production figures in a challenging gold market.

Brad Gordon, who took on the top role at the FTSE 250-listed gold explorer last August, told City A.M. that this was the fifth consecutive quarter the company had beaten targets, with costs down 19 per cent on the comparative period the previous year.

“We’re adapting to the new price environment,” he said, in light of the steep decline in the gold price over the past year. “The company is different to what it was a year ago and will be different again in a year.”

Full-year production of 641,931 ounces hit the upper end of guidance, beating analysts’ forecasts. Cash costs for 2013 of $827 (£502) per ounce were well below guidance of $925 per ounce and again beat analysts’ estimates.

African Barrick Gold had a management overhaul last year, replacing both its chief executive and chief financial officer in a matter of weeks, as it struggled with operational issues and wider market challenges. Last July it wrote down the value of its mines by $727m (£464m), having reported first-half losses of $701m.

“There has been a lot of change on a management level, but my leadership group is stable now and I don’t see that changing for the next couple of years,” said Gordon. “We also changed the general managers at a number of mines a few months ago so we are going to see more stability there now.”

Shares closed up 2.94 per cent.