Everything you thought you knew about the global banking crisis was wrong

You thought the crisis was global. You thought the problem was banks’ losses on boom-era loans.

You were wrong, according to these startling four charts from Oliver Wyman.

Banks in Latin America and Asia-Pacific are doing just fine, the consultancy’s numbers show.

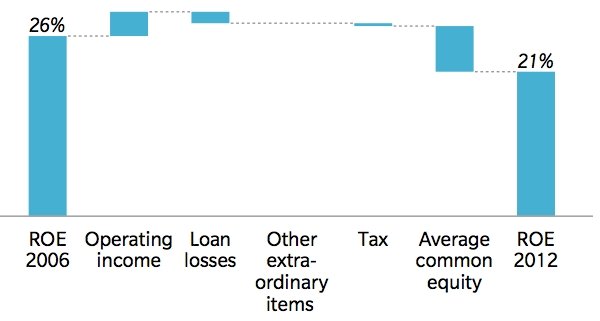

Drivers of changes in banking returns 2006-12, for the largest banks in Latin America

In LatAm return on equity has barely shifted, falling from 26 per cent in 2006 to 21 per cent in 2012.

Drivers of changes in banking returns 2006-12, for the largest banks in Asia-Pacific

And in Asia-Pacific it is down from 18 per cent to 17 per cent.

Drivers of changes in banking returns 2006-12, for the largest banks in North America

Contrast that with the picture in the US – as we know banks there suffered, and returns are down from 19 per cent to nine per cent.

Drivers of changes in banking returns 2006-12, for the largest banks in Europe

In Europe the carnage is even worse, with return on equity down from 20 per cent to four – crippling, bearing in mind the cost of capital is estimated to be around 12 per cent or so.

So that is the “global” crisis debunked.

The cause of banks’ woes is also up for debate – banks have certainly made big losses on bad loans, but by 2012 the biggest factor dragging down returns in Europe and the US was in fact building up capital buffers.

Regulators want it to make banks safer, but it is clearly a drag on banks’ profits and lending.

“Several of the most developed financial sectors now find themselves on a hard path – struggling to profit in the face of slow economic and credit growth, customer distrust, market saturation, and burdensome regulation,” warns Wyman’s report into the state of financial services.

“In wholesale banking, the pressure of increased operating and capital costs presage a shake-out of capacity which is already reducing market liquidity and, especially in Europe, restricting access to credit for non-rated companies.”