Investment arm leads profits up at Credit Suisse

WEALTH management profits have slipped at Credit Suisse, but a revival in investment banking revenues saw group profits jump in the second quarter, the bank said yesterday.

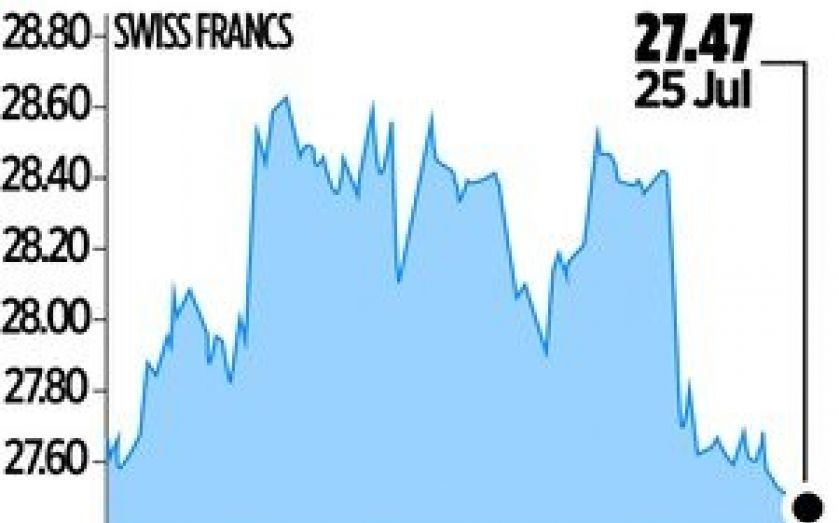

Group profits rose 33 per cent on the year to SFr1.05bn (£734m), lifting return on equity from 9.2 per cent to 10.1 per cent.

Switzerland’s famed financial privacy laws are under attack, sending expenses up more quickly than revenues in Credit Suisse’s private banking and wealth management arm.

The unit recorded a pre-tax profit of SFr917m, down six per cent on the SFr977m a year earlier, as revenues rose one per cent to SFr3.4bn but operating expenses jumped three per cent to SFr2.5bn.

This slide contrasts with investment banking, where net revenues shot up 24 per cent to SFr3.4bn and operating expenses rose eight per cent to SFr2.6bn, meaning pre-tax profits soared 140 per cent to SFr754m.

The group has cut costs vigorously, reducing headcount by 1,900, from 48,200 a year ago to 46,300.

And it reported a Basel III common equity tier one ratio of 15.3 per cent, up from 14.6 per cent three months earlier.

“The transition to higher interest rates led, in the latter part of the second quarter, to increased market volatility and reduced client activity. This market volatility continued into July, although more recently we have seen signs of stabilisation in our major markets,” said chief executive Brady Dougan in a statement.

“In the longer term, the transition to higher rates will benefit our business, both our global private banking and wealth management franchise and our client-focused, capital-efficient investment banking business.”