European commercial real estate market is swimming in debt

Research out today by CBRE shows how the European commercial real estate market is still up to its eyeballs in debt – a large chunk of which is unlikely to meet its maturity deadlines unless new lenders such as insurers ramp up their activity.

According to the property consultancy, there is €926bn (£762bn) of outstanding commercial real estate (CRE) debt across Europe – just 11 per cent lower than level seen at the peak of the financial crisis in 2008.

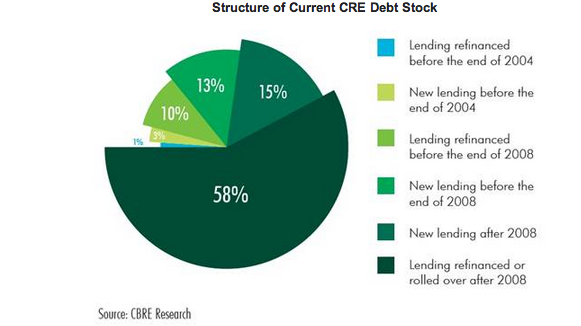

However, CBRE estimates that around 15 per cent of the total is from debt that has been issued against new commercial property deals since the end of 2008 and that 24 per cent (€244bn) of the debt that existed at the end of 2008 has now been retired.

Despite progress being made by banks and other legacy lenders to reduce their exposure – particularly in the UK when banks have been busy selling loan portfolios – in many instances lenders have tried to sweep the problem under the carpet by resorting to solutions such as roll-over loans and short-term extensions.

This means that 79 per cent (€731bn) of the total outstanding debt is due to mature in the next five years.

On top of this, new lenders, such as debt funds, insurers, private equity and capital markets are still very much in their infancy and have not yet entered the market to the level required to make a significant impact.

In short, CBRE concludes that the process of unwinding Europe’s legacy real estate debt will continual to be a gradual one, with a high reliance on these new opportunistic loan purchasers.

Paul Lewis, head of special servicing at CBRE, said:

After a prolonged period when European debt strategies were dominated by extensions and forbearance, we are now seeing lenders take a more aggressive stance actively dealing with their non-performing property loans.

The deleveraging process is now well underway, albeit concentrated in the UK where legacy lenders are starting to reduce exposure with a renewed sense of urgency and take the write-downs required to break the capital structures that have previously prevented assets being sold.

However, many Eurozone banks still retain a large debt overhang and until the ‘new lenders’ enter the market in earnest there is unlikely to be enough debt retired to hit maturity deadlines.