London housing begins to price out businesses

BUSINESSES warned the government today that rising property prices could undermine investment in the capital, as firms struggle to keep up.

According to the statement by the Confederation of British Industry (CBI) and KPMG, the shortage of housing has risen from companies’ third most pressing concern to their second since December, overtaking transport.

The number of businesses that wish to expand in London has fallen since the end of 2012, from 54 per cent to 29 per cent, while the number looking to expand overseas has risen.

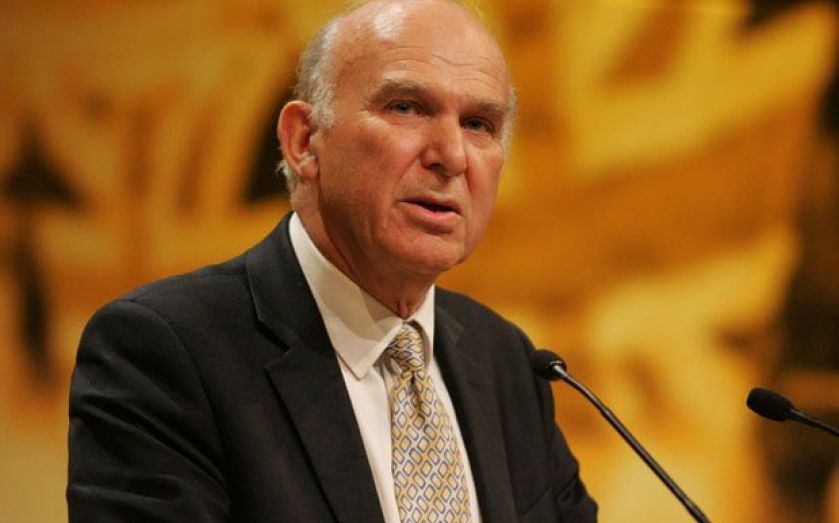

To add to concerns over the market, business secretary Vince Cable said that he had warned about the potential negative effects of the chancellor’s help to buy scheme, saying: “I am worried about the danger of getting into another housing bubble”.

The capital’s property market is still steaming ahead of the rest of the UK, with prices rising at a faster rate. Hometrack’s most recent survey registered a 0.7 per cent increase in London prices through July so far, compared to a 0.3 per cent increase nationally.

The average amount of time that British houses are spending on the market has fallen to 8.2 weeks, the lowest level in six years. Despite this historically low level, London houses sell twice as fast, staying unsold for less than a month.

Although the Treasury’s help to buy scheme will only apply to houses worth up to £600,000, Knight Frank expects higher prices even for the most expensive properties, citing an infectious effect across the market.

The property consultancy also raised its forecast for price growth in prime locations to six per cent for this year, claiming that a weaker pound has boosted international spending on homes in the capital.