Forget the EM crisis. Fed tapering will leave France without a paddle

Emerging markets continue to feel the pain of the Federal Reserve’s taper, but trouble could be rapidly approaching for another struggling economy – France.

Research by Rabobank, looking at narrowing spreads in the Eurozone periphery, concluded that economic fundamentals are set to be an increasingly important driver of capital markets as the taper progresses. And with the tide of central bank liquidity in retreat, France may be left stranded.

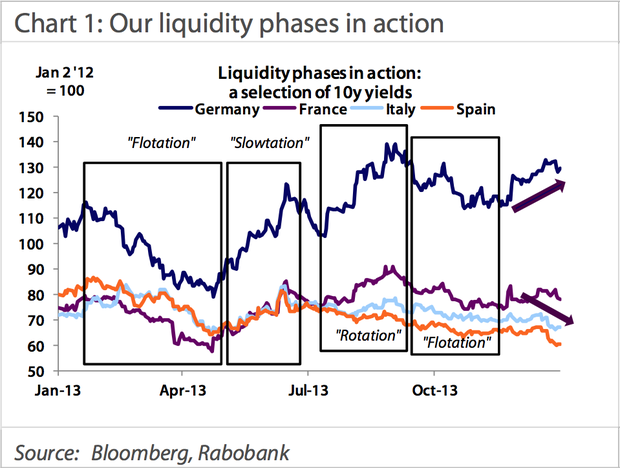

As the following chart shows, 10-year Eurozone peripheral bond yields have been steadily declining since last summer.

Part of this is due to what Rabobank calls the Great Flotation – when the Fed failed to taper in September, markets were unexpectedly awash with capital, supporting assets of all risk profiles.

Jumping forward, however, we see a curious theme.

While peripheral yields have broadly continued to steady, the direction of travel in “core” bonds like German bunds has been in the opposite direction (see the top blue line above). This is not what we’d expect if liquidity was supporting assets across the board.

Rabobank thinks this might be evidence of the increased influence of economic fundamentals – the narrowing of spreads between the core and periphery reflecting the higher confidence in countries like Italy and Spain relative to a few years ago.

Using the European Commission’s economic confidence survey as a proxy, there seems to be evidence for this theory:

Effectively, as central bank stimulus recedes, investors will become more discerning with where they put their money, and countries like Spain that were relatively thoroughgoing with the implementation of structural reforms will benefit.

France, on the other hand, is a different question entirely.

The following chart uses OECD economic indicators as a proxy to measure the progress of structural reforms throughout the crisis.

According to Rabobank, France seems to be lagging behind the rest of the bloc in terms of the uptick from structural reforms:

[France’s] relative insulation through the crisis period allowed it to avoid addressing its own structural shortcomings – a development that looks to be behind the fact that France is now conspicuously lagging the broader regional upturn.

France failed to use the safety blanket of extraordinary monetary stimulus to introduce a raft of sorely-needed measures. And if economic fundamentals are making a comeback, there will be a tipping point – the bonds of ailing economies like France could be hit. Hard.

This point may not be reached until the tapering process is completed. But the note’s authors also highlight upcoming elections as a possible milestone:

The March local elections bear watching in this regard, not perhaps owing to a likely good showing on the part of the National Front, but rather the potentially negative implications of such an outcome for government policy (i.e. via the higher risk this implies of President Hollande unveiling populist measures to shore up support).

Much of the commentary on the retreat of the Fed’s taper has focused on the implications for economies in the developing world with high current account deficits. As the recent emergency measures in India and Turkey illustrate, they have taken this danger seriously. If Rabobank’s analysts are correct, France should do the same.