Next ups profit forecast despite volatile trading

NEXT warned yesterday that British shoppers are becoming more “spontaneous”, making sales more vulnerable to short-term events such as a change in the weather or a bank holiday.

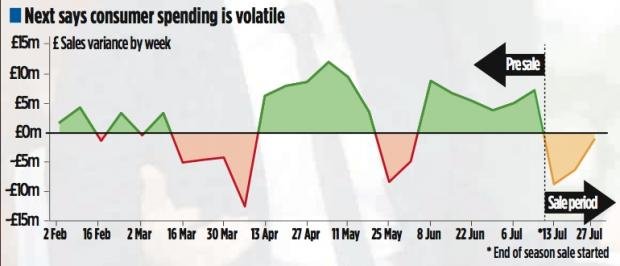

In a graph released alongside its half-year results, the retailer highlighted huge swings in weekly spend, with total sales down by as much as £10m in weeks of bad weather, and up a similar amount when temperatures soared.

“We do not believe increased volatility has much effect on overall spending, but it does mean short-term consumer trends are harder to read,” chief executive Lord Wolfson said.

His comments came as the clothing chain reported a 2.3 per cent increase in sales for the 26 weeks to 27 July, driven by a strong performance from its Directory internet and catalogue business.

Next’s store sales were down 0.9 per cent, while Directory rose 8.3 per cent.

The FTSE 100 group, which has around 500 stores in the UK and Ireland and 200 stores overseas, said it had sold more items at full-price, meaning that it went into its summer sale with 20 per cent less stock.

The increase in full-price sales and lower markdowns has boosted first half profits by £10m, prompting the retailer to raise its full-year pre-tax profit forecast from £615m-£665m to £635m-£675m.

The company also increased its share buyback guidance from £250m to a wider range of £250m to £350m, helping to send up shares by 2.4 per cent to close at 5,020p last night.